IF...as our "fearless leader that couldn't lead a horse to water" President, AND our "I've never told the truth about a damn thing" Federal Reserve Chairman would have you "believe", the US Economy is growing and in "recovery", then:

Why has the Fed injected $16 TRILLION into the banking system since 2008?

Why Is Gasoline Consumption Tanking?

Gasoline deliveries reflect recession and growth. The recent drop in retail gasoline deliveries is signalling a sharp contraction ahead.

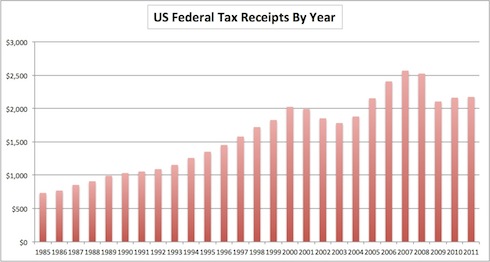

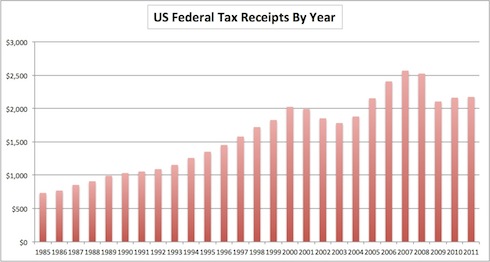

Why are tax revenues continuing to fall?

...through last Friday, and net of tax refunds, total US tax revenues were actually lower in the fiscal 2012 year to date period than compared to 2011, by just under $2 billion, at $625.5 billion. Which is the weakest link for any argument that the US is actually growing: what is growing is America's debt (now almost exponentially), while its revenues are at best unchanged.

-ZeroHedge

Why are the Non-Farm Payrolls numbers NOT supported by reported income tax collections?

...the BLS refuses to use the data embedded in income tax collections to be able to report real time jobs and wages. Why does it refuse? Could the reason it refuses to use real time data on jobs and incomes be because perhaps this jobs number is politically motivated? The entire world is looking at U.S. job creation as a proxy on how well Obama is doing? Could the Obama Administration be pressuring its economist employees to create the best possible new jobs number?

How can the stock markets keep rising when individuals have been net sellers for the past several years?

"Individuals are net sellers of US equities and have been for years, probably because they need to pay bills and stuff. So how are they able to do that and get decent prices without the stock market cracking. Well simple the Federal Reserve has been printing huge amounts of money and that ultimately has been boosting the value of US equities, and therefore the sellers can sell."

-TrimTabs Charles Biderman

THERE IS NO RECOVERY, AND THERE IS NO GROWTH.

An illusion of both has been, and is being, painted by those with a sound bite voice. The President is a liar, the Fed Chairman is a liar, and Americans are fools to believe their lies. There is only one thing, and one thing only that is growing rapidly in America, and that one thing is DEBT.

January

Consumer Credit Surges As Government Blows Student Debt Bubble To Epic

Proportions

The government has an exploding debt problem as well:

"...final February deficit was just released and the actual print is $231.7 billion.

It also means that in the first 5 months of the fiscal year, the US has raked up

$580 billion in deficits, oddly matched by $727 billion in new debt

issuance, 25% more new debt issued than needed to fund deficits..."

-Zero Hedge

And yet the prices of Gold and Silver remain under pressure? Funny thing about the take downs of the price of Gold and Silver over the past 10 years...they ALWAYS precede or coincide with massive money injections into the World Financial System by the US Federal Reserve and the European Central Bank.

Observe the chart below I saw at www.lemetropolecafe.com [Please subscribe]:

The chart below plots the Federal Reserve System's total assets, the European

Central Bank's total assets and the price of gold over time. There are many who

argue that gold is in a bubble and they could well be right but looking at this

chart it seems that the real bubble is in the recklessness and irresponsibility

of Messrs Bernanke's and Draghi's policy of creating money out of thin air to

buy assets!

Is it "just a coincidence" that the price of Gold was smashed in the Spring of 2008 prior the Fed and ECB money printing in the Fall of 2008? The Fall of 2009? The Fall of 2010? The September 2011 hit on the Precious Metals as the ECB went hog wild printing money? This is NO COINCIDENCE people! This is a blatant effort by those that too many trust to deceive us into believing "nothing is wrong, the government will fix everything".

BULLSHIT!!!

Deceive though they may, and rig as they might, the Fed, the ECB and western governments are POWERLESS to "stop" the rise in Gold and Silver prices...

THE CHART SPEAKS FOR ITSELF

Despite every effort, the price of Gold has continued to rise as the Fed and ECB print money to delude the world into believing that an economic recovery is occuring "right before our eyes"!

Is it a safe bet that the price of Gold will triple at a minimum over the next two years? Look at the chart above again. Following the take down in Gold in the Spring of 2008 and the subsequent ramp in assets of the Fed and ECB [money printing], what did the price of Gold do? That's right, IT TRIPLED! Do not doubt for a day that it will not at least TRIPLE again from current prices by the end of next year.

America is NOT in a recovery. America is in a DEPRESSION masked by US Federal Reserve money printing, and the lies of the Obama Administration.

Five Charts That Prove We’re in a Depression and That the Federal Reserve and Washington Are Wasting Money

Why has the Fed injected $16 TRILLION into the banking system since 2008?

Why Is Gasoline Consumption Tanking?

Gasoline deliveries reflect recession and growth. The recent drop in retail gasoline deliveries is signalling a sharp contraction ahead.

Why are tax revenues continuing to fall?

...through last Friday, and net of tax refunds, total US tax revenues were actually lower in the fiscal 2012 year to date period than compared to 2011, by just under $2 billion, at $625.5 billion. Which is the weakest link for any argument that the US is actually growing: what is growing is America's debt (now almost exponentially), while its revenues are at best unchanged.

-ZeroHedge

Why are the Non-Farm Payrolls numbers NOT supported by reported income tax collections?

...the BLS refuses to use the data embedded in income tax collections to be able to report real time jobs and wages. Why does it refuse? Could the reason it refuses to use real time data on jobs and incomes be because perhaps this jobs number is politically motivated? The entire world is looking at U.S. job creation as a proxy on how well Obama is doing? Could the Obama Administration be pressuring its economist employees to create the best possible new jobs number?

How can the stock markets keep rising when individuals have been net sellers for the past several years?

"Individuals are net sellers of US equities and have been for years, probably because they need to pay bills and stuff. So how are they able to do that and get decent prices without the stock market cracking. Well simple the Federal Reserve has been printing huge amounts of money and that ultimately has been boosting the value of US equities, and therefore the sellers can sell."

-TrimTabs Charles Biderman

THERE IS NO RECOVERY, AND THERE IS NO GROWTH.

An illusion of both has been, and is being, painted by those with a sound bite voice. The President is a liar, the Fed Chairman is a liar, and Americans are fools to believe their lies. There is only one thing, and one thing only that is growing rapidly in America, and that one thing is DEBT.

Is it "just a coincidence" that the price of Gold was smashed in the Spring of 2008 prior the Fed and ECB money printing in the Fall of 2008? The Fall of 2009? The Fall of 2010? The September 2011 hit on the Precious Metals as the ECB went hog wild printing money? This is NO COINCIDENCE people! This is a blatant effort by those that too many trust to deceive us into believing "nothing is wrong, the government will fix everything".

BULLSHIT!!!

Deceive though they may, and rig as they might, the Fed, the ECB and western governments are POWERLESS to "stop" the rise in Gold and Silver prices...

THE CHART SPEAKS FOR ITSELF

Despite every effort, the price of Gold has continued to rise as the Fed and ECB print money to delude the world into believing that an economic recovery is occuring "right before our eyes"!

Is it a safe bet that the price of Gold will triple at a minimum over the next two years? Look at the chart above again. Following the take down in Gold in the Spring of 2008 and the subsequent ramp in assets of the Fed and ECB [money printing], what did the price of Gold do? That's right, IT TRIPLED! Do not doubt for a day that it will not at least TRIPLE again from current prices by the end of next year.

America is NOT in a recovery. America is in a DEPRESSION masked by US Federal Reserve money printing, and the lies of the Obama Administration.

Five Charts That Prove We’re in a Depression and That the Federal Reserve and Washington Are Wasting Money

By Graham Summers

Wall Street and mainstream economists are abuzz with chatter that we’re seeing a recovery in the US due to the latest jobs data. These folks are not only missing the big picture, but they’re not even reading the fine print (more on this in a moment).

The reality is that what’s happening in the US today is not a cyclical recession, but a one in 100 year, secular economic shift.

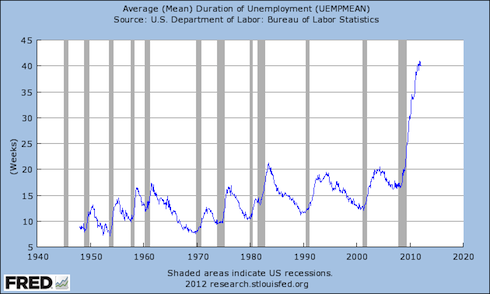

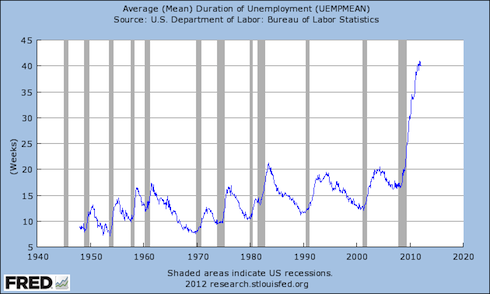

See for yourself. Here’s duration of unemployment. Official recessions are marked with gray columns. While the chart only goes back to 1967 I want to note that we are in fact at an all-time high with your average unemployed person needing more than 40 weeks to find work (or simply falling off the statistics).

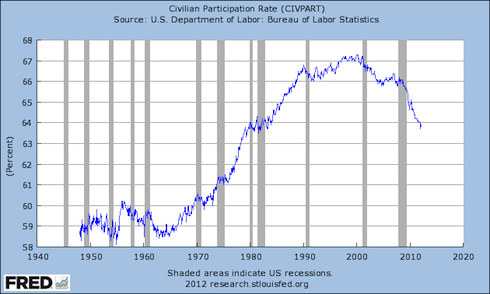

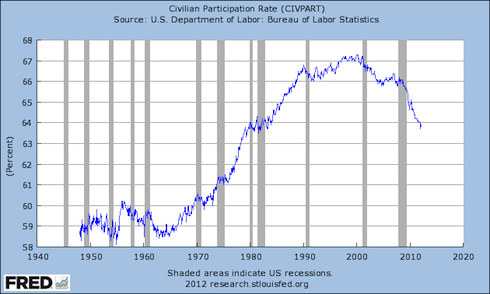

Here’s the labor participation rate with recessions again market by gray columns:

Here’s the labor participation rate with recessions again market by gray columns:

Another way to look at this chart is to say that since the Tech Crash, a smaller and smaller percentage of the US population has been working. Today, the same percentage of the US population are working as in 1980.

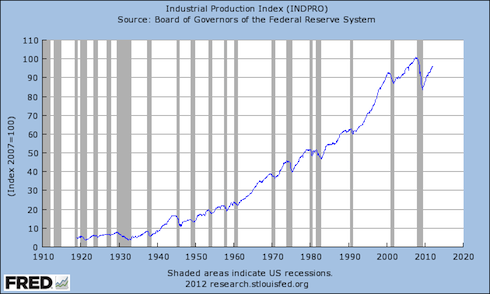

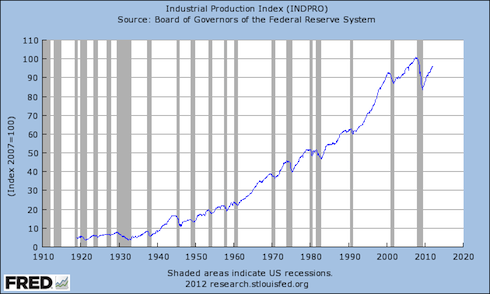

Here’s industrial production. I want to point out that during EVERY recovery since 1919 industrial production has quickly topped its former peak. Not this time. We’ve spent literally trillions of US Dollars on Stimulus and bailouts and production is well below the pre-Crisis highs.

Here’s a close up of the last 10 years.

Here’s a close up of the last 10 years.

Again, what’s happening in the US is NOT a garden-variety cyclical recession. It is STRUCTURAL SECULAR DEPRESSION.

As for the jobs data… while the headlines claim we’re adding 200K+ jobs per month the sad fact is that without adjustments we’ve lost jobs 1.8 million jobs so far in 2012.

Not only is this data point actually in the JOBS REPORTS THEMSELVES… but it’s supported by the fact that taxes (which are closely tied to actual incomes/ jobs) are in fact below 2005 levels.

Folks, this is a DE-pression. And those who claim we’ve turned a corner are going by “adjusted” AKA “massaged” data. The actual data (which is provided by the Federal Reserve and Federal Government by the way) does not support these claims at all. In fact, if anything they prove we’ve wasted money by not permitted the proper debt restructuring/ cleaning of house needed in the financial system.

It all boils down to the same simple sentence repeated by myself and others: you cannot solve a debt problem by issuing more debt (even if it’s at better rates).

Indeed, take a look at Greece today. The ECB and IMF have spent two years trying to post-pone a real default. Having wasted over €200 billion, they’ve now let Greece stage a pseudo-default (at least in their minds)… which, by the way, has only actually increased Greece’s debt load and crippled its economy.

Just like in the US. And while the topic of a US default is not openly discussed today, it’s evident that what’s happening in Greece will eventually come our way, after first making stop at the other PIIGS countries as well as Japan.

Which is why smart investors are already preparing for a global debt implosion. And they’re doing it by carefully constructing portfolios that will profit from it (while also profiting from Central Bank largesse in the near-term).

Time to Accumulate Gold and Silver

Jeff Clark, Senior Precious Metals Analyst, Casey Research

Regardless of what you think will happen over the remainder of this decade, one thing seems virtually certain: the value of paper money will be affected, perhaps dramatically. Even if the economy slips into deflation, the deflation wouldn't last long. A panicked Fed would print to the max and set off a wild rise in prices. This is why we're convinced currency dilution will not only continue but accelerate.

Let's take a look at what's happened so far with the value of our currency vs. gold, after accounting for the loss in purchasing power.

_____________________________

Got Gold You Can Hold?

Got Silver You Can Squeeze?

It's Not Too Late To Accumulate!

The reality is that what’s happening in the US today is not a cyclical recession, but a one in 100 year, secular economic shift.

See for yourself. Here’s duration of unemployment. Official recessions are marked with gray columns. While the chart only goes back to 1967 I want to note that we are in fact at an all-time high with your average unemployed person needing more than 40 weeks to find work (or simply falling off the statistics).

Here’s the labor participation rate with recessions again market by gray columns:

Here’s the labor participation rate with recessions again market by gray columns:

Another way to look at this chart is to say that since the Tech Crash, a smaller and smaller percentage of the US population has been working. Today, the same percentage of the US population are working as in 1980.

Here’s industrial production. I want to point out that during EVERY recovery since 1919 industrial production has quickly topped its former peak. Not this time. We’ve spent literally trillions of US Dollars on Stimulus and bailouts and production is well below the pre-Crisis highs.

Here’s a close up of the last 10 years.

Here’s a close up of the last 10 years.

Again, what’s happening in the US is NOT a garden-variety cyclical recession. It is STRUCTURAL SECULAR DEPRESSION.

As for the jobs data… while the headlines claim we’re adding 200K+ jobs per month the sad fact is that without adjustments we’ve lost jobs 1.8 million jobs so far in 2012.

Not only is this data point actually in the JOBS REPORTS THEMSELVES… but it’s supported by the fact that taxes (which are closely tied to actual incomes/ jobs) are in fact below 2005 levels.

Folks, this is a DE-pression. And those who claim we’ve turned a corner are going by “adjusted” AKA “massaged” data. The actual data (which is provided by the Federal Reserve and Federal Government by the way) does not support these claims at all. In fact, if anything they prove we’ve wasted money by not permitted the proper debt restructuring/ cleaning of house needed in the financial system.

It all boils down to the same simple sentence repeated by myself and others: you cannot solve a debt problem by issuing more debt (even if it’s at better rates).

Indeed, take a look at Greece today. The ECB and IMF have spent two years trying to post-pone a real default. Having wasted over €200 billion, they’ve now let Greece stage a pseudo-default (at least in their minds)… which, by the way, has only actually increased Greece’s debt load and crippled its economy.

Just like in the US. And while the topic of a US default is not openly discussed today, it’s evident that what’s happening in Greece will eventually come our way, after first making stop at the other PIIGS countries as well as Japan.

Which is why smart investors are already preparing for a global debt implosion. And they’re doing it by carefully constructing portfolios that will profit from it (while also profiting from Central Bank largesse in the near-term).

Time to Accumulate Gold and Silver

Jeff Clark, Senior Precious Metals Analyst, Casey Research

Regardless of what you think will happen over the remainder of this decade, one thing seems virtually certain: the value of paper money will be affected, perhaps dramatically. Even if the economy slips into deflation, the deflation wouldn't last long. A panicked Fed would print to the max and set off a wild rise in prices. This is why we're convinced currency dilution will not only continue but accelerate.

Let's take a look at what's happened so far with the value of our currency vs. gold, after accounting for the loss in purchasing power.

_____________________________

Got Gold You Can Hold?

Got Silver You Can Squeeze?

It's Not Too Late To Accumulate!

No comments:

Post a Comment