As I have noted countless times herein this blog, the first three letters of the word confidence spell CON. And if ever there was an example of this "sentiment" we need look no further than this past Friday's US Non-farm Payrolls report.

If ever there was a shit sandwich served to the unfortunate masses that are "out of work", this Happy Meal of positive jobs news could best be interpreted as a shot of epicap.

There was nothing positive about the January jobs report ...unless you are the incumbent in the White House in an election year. To say this payrolls report was sign of growth in US jobs would be a bald face lie.

As has been said, "the devil is in details", and in this jobs report, the details expose a despotic attempt by the US Government to CON the entire World into believing that the US economy is "strong and in recovery".

The mainstream financial news media, and the pathetic muppets on CNBS, trumpeted the stunning revelation that the economy "created" 243K new jobs in January as if they were witness to the Phoenix rising. None questioned the validity of this number when so many of these talking heads had expected far less "job creation" in January.

The financial news media, and the government call it "jobs creation" for a reason. The jobs are created out of thin air, much the same way the US Federal Reserve creates money out of thin air.

It's a joke right?

Jim Sinclair’s Commentary

Employment statistics as taught by the two revered classical economists, Abbott and Costello. Courtesy of CIGA Lew

COSTELLO: I want to talk about the unemployment rate in America.

ABBOTT: Good Subject. Terrible Times. It’s 8.3%.

COSTELLO: That many people are out of work?

ABBOTT: No, that’s 16%.

COSTELLO: You just said 8.3%.

ABBOTT: 8.3% Unemployed.

COSTELLO: Right 8.3% out of work.

ABBOTT: No, that’s 16%.

COSTELLO: Okay, so it’s 16% unemployed.

ABBOTT: No, that’s 8.3%…

COSTELLO: WAIT A MINUTE. Is it 8.3% or 16%?

ABBOTT: 8.3% are unemployed. 16% are out of work.

COSTELLO: IF you are out of work you are unemployed.

ABBOTT: No, you can’t count the "Out of Work" as the unemployed. You have to look for work to be unemployed.

COSTELLO: BUT THEY ARE OUT OF WORK!!!

ABBOTT: No, you miss my point.

COSTELLO: What point?

ABBOTT: Someone who doesn’t look for work, can’t be counted with those who look for work. It wouldn’t be fair.

COSTELLO: To who?

ABBOTT: The unemployed.

COSTELLO: But they are ALL out of work.

ABBOTT: No, the unemployed are actively looking for work… Those who are out of work stopped looking.

They gave up and if you give up, you are no longer in the ranks of the unemployed.

COSTELLO: So if you’re off the unemployment rolls, that would count as less unemployment?

ABBOTT: Unemployment would go down. Absolutely!

COSTELLO: The unemployment just goes down because you don’t look for work?

ABBOTT: Absolutely it goes down. That’s how you get to 8.3%. Otherwise it would be 16%. You don’t want to read about 16% unemployment do ya?

COSTELLO: That would be frightening.

ABBOTT: Absolutely.

COSTELLO: Wait, I got a question for you. That means there are two ways to bring down the unemployment number?

ABBOTT: Two ways is correct.

COSTELLO: Unemployment can go down if someone gets a job?

ABBOTT: Correct.

COSTELLO: And unemployment can also go down if you stop looking for a job?

ABBOTT: Bingo.

COSTELLO: So there are two ways to bring unemployment down, and the easier of the two is to just stop looking for work.

ABBOTT: Now you’re thinking like an economist.

COSTELLO: I don’t even know what the hell I just said!

______________________________

FORTUNATELY, there are those in the "alternative financial news media" that possess functioning bullshit detectors, and are thankfully willing to report the TRUTH about this bogus January jobs report.

BY now, many of you may have already seen the TRUTH in print regarding this jobs CON. None captured the LIE and none reported it better than ZeroHedge. Below I offer a collection of "truthful observations" regarding the January Non-farm Parolls report beginning with the inimitable ZeroHedge. Follow along as ZeroHedge and others deconstruct the January Non-farm Payrolls report and reveal the CON in confidence:

Record 1.2 Million People Fall Out Of Labor Force In One Month, Labor Force Participation Rate Tumbles To Fresh 30 Year Low

Submitted by Tyler Durden on 02/03/2012 - 08:51 BLS Bureau of Labor Statistics Unemployment Withholding taxes

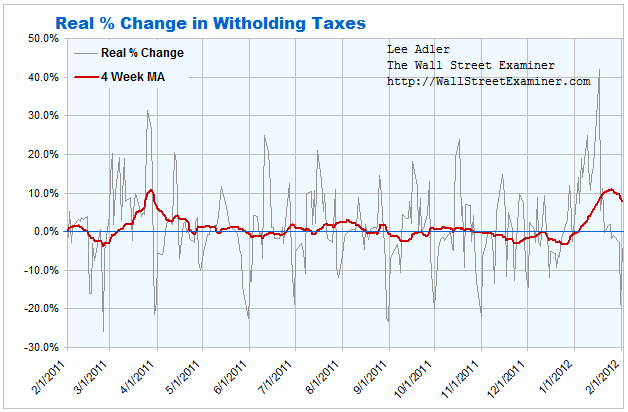

A month ago, we joked when we said that for Obama to get the unemployment rate to negative by election time, all he has to do is to crush the labor force participation rate to about 55%. Looks like the good folks at the BLS heard us: it appears that the people not in the labor force exploded by an unprecedented record 1.2 million. No, that's not a typo: 1.2 million people dropped out of the labor force in one month! So as the labor force increased from 153.9 million to 154.4 million, the non institutional population increased by 242.3 million meaning, those not in the labor force surged from 86.7 million to 87.9 million. Which means that the civilian labor force tumbled to a fresh 30 year low of 63.7% as the BLS is seriously planning on eliminating nearly half of the available labor pool from the unemployment calculation. As for the quality of jobs, as withholding taxes roll over Year over year, it can only mean that the US is replacing high paying FIRE jobs with low paying construction and manufacturing. So much for the improvement.

Nonfarm Payroll Surge... On Gain From "Low Wage Jobs", Delay In Courier, Messenger Job Drop

Submitted by Tyler Durden on 02/03/2012 - 09:08 BLS Bureau of Labor Statistics Unemployment Withholding taxesGreat news from today's BLS report, right (when one excludes that record 1.2 million explosion in people out of the labor force of course)? Wrong. As is well known banks have been firing workers left and right: these are the jobs that actually matter in the grand withholding taxes scheme of things. Yet someone is getting hired supposedly. Well, as we suggested before the NFP report, this is merely rotation from high paying jobs to "low-wage jobs." And no, it's not our words - this is what CRT Capital says. Per Bloomberg: About 113k of NFP gain from “low wage jobs,” David Ader, strategist at CRT Capital Group, writes in note. Additionally, “we didn’t see the drop in courier and messengers as expected - but suspect we will." Moreover, ‘‘long-term stress remains at the U6 measure at 15.1% is still high, but likely falling due to people leaving labor force, and duration on unemployment remains over 40 weeks." But yes, it is an election year, so by November expect the labor participation rate to be under 60% and the unemployment rate to drop to under 6%, or some other propaganda BS.

Implied Unemployment Rate Rises To 11.5%, Spread To Propaganda Number Surges To 30 Year High

Submitted by Tyler Durden on 02/03/2012 - 09:35 BLS Bureau of Labor Statistics Real Unemployment Rate Unemployment

Sick of the BLS propaganda? Then do the following calculation with us: the US civilian non-institutional population was 242,269 in January, an increase of 1.7 million month over month: apply the long-term average labor force participation rate of 65.8% to this number (because as chart 2 below shows, people are not retiring as the popular propaganda goes: in fact labor participation in those aged 55 and over has been soaring as more and more old people have to work overtime, forget retiring), and you get 159.4 million: that is what the real labor force should be. The BLS reported one? 154.4 million: a tiny 5 million difference. Then add these people who the BLS is purposefully ignoring yet who most certainly are in dire need of labor and/or a job to the 12.758 million reported unemployed by the BLS and you get 17.776 million in real unemployed workers. What does this mean? That using just the BLS denominator in calculating the unemployed rate of 154.4 million, the real unemployment rate actually rose in January to 11.5%. Compare that with the BLS reported decline from 8.5% to 8.3%. It also means that the spread between the reported and implied unemployment rate just soared to a fresh 30 year high of 3.2%. And that is how with a calculator and just one minute of math, one strips away countless hours of BLS propaganda.

Non-Manufacturing ISM Ignores Banker Layoffs, Surges Past Expectations On Biggest Jump In Employment Index Ever

Submitted by Tyler Durden on 02/03/2012 - 10:18 Non-manufacturing ISM

And another major economic indicator beat, this time coming from the January Non-manufacturing ISM data, which unlike yesterday's miss in the manufacturing ISM, surged past estimates of 53.2, up from a revised 53.0 in December, to a whopping 56.8 in January. The primary reason for this was the reported jump in Employment which rose from 49.8 to 57.4, which was the biggest jump pretty much ever (see chart below), and the highest employment number since 2006. And this happened in a month in which the banking sectors laid of thousands of bankers. Brilliant. We leave it up to readers to estimate the credibility of this report. In other news, inflation is back, as the report states that "Corrugated Cartons is the only commodity reported down in price." What was up? "Airfares; Beef; Chemical Products; Chicken; Crab; Coffee (2); #1 Diesel Fuel (2); #2 Diesel Fuel (3); Fuel; Gasoline; Medical Supplies (2); Paper; Petroleum Based Products; Resin Based Products; Vehicles; and Wire." In other news, factory order missed expectations of a 1.5% increase, coming in at 1.1%. But who cares: it is an election year and the propaganda machine is on in full force.

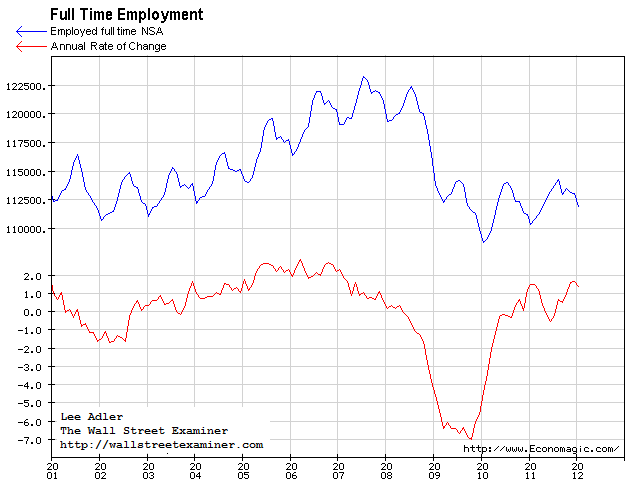

Final Nail In Today's NFP Tragicomedy: Record Surge In Part-Time Workers

Submitted by Tyler Durden on 02/03/2012 - 10:52 It appears the record surge in people not in the labor force is not the only outlier in today's data. For the other one we go to the Household Data Survey (Table 9), and specifically the breakdown between Full Time and Part Time Workers (defined as those "who usually work less than 35 hours per week"). We won't spend too much time on it, as it is self-explanatory. In January, the number of Part Time workers rose by 699K, the most ever, from 27,040K to 27,739K, the third highest number in the history of this series. How about Full time jobs? They went from 113,765 to 113,845. An 80K increase. So the epic January number of 141.6 million employed, which rose by 847K at the headline level: only about 10 % of that was full time jobs: surely an indicator of the resurgent US economy... in which employers can't even afford to give their workers full time employee benefits. We can't wait for Mr. Liesman to explain how this number, too, is unadulterated hogwash, and how it too is explained away to confirm economic strength. Incidentally this is not the first time we have discussed the issue of part vs full time workers: for more see here: "Charting America's Transformation To A Part-Time Worker Society, Following 6 Straight Months Of Full Time Job Declines"

It appears the record surge in people not in the labor force is not the only outlier in today's data. For the other one we go to the Household Data Survey (Table 9), and specifically the breakdown between Full Time and Part Time Workers (defined as those "who usually work less than 35 hours per week"). We won't spend too much time on it, as it is self-explanatory. In January, the number of Part Time workers rose by 699K, the most ever, from 27,040K to 27,739K, the third highest number in the history of this series. How about Full time jobs? They went from 113,765 to 113,845. An 80K increase. So the epic January number of 141.6 million employed, which rose by 847K at the headline level: only about 10 % of that was full time jobs: surely an indicator of the resurgent US economy... in which employers can't even afford to give their workers full time employee benefits. We can't wait for Mr. Liesman to explain how this number, too, is unadulterated hogwash, and how it too is explained away to confirm economic strength. Incidentally this is not the first time we have discussed the issue of part vs full time workers: for more see here: "Charting America's Transformation To A Part-Time Worker Society, Following 6 Straight Months Of Full Time Job Declines"TrimTabs Explains Why Today's "Very, Very Suspicious" NFP Number Is Really Down 2.9 Million In Past 2 Months

Submitted by Tyler Durden on 02/03/2012 - 15:01 BLS Bureau of Labor Statistics Charles Biderman Congressional Budget Office Federal Tax SIFMA TrimTabs Unemployment We have examined the nuance of the euphoric jobs data this morning from every angle and by now there should be plenty of 'information' for investors to make their own minds up on its credibility. However, the avuncular CEO of TrimTabs, who despite channeling Lewis Black lately, likely knows this data a little better than the average Jim on the street having collected tax witholdings data for the past 14 years, is modestly apoplectic at the adjustments. In one of his more colorful episodes, and rightfully so, Charles Biderman notes that "Either there is something massively changed in the income tax collection world, or there is something very, very suspicious about today’s BLS hugely positive number," adding, "Actual jobs, not seasonally adjusted, are down 2.9 million over the past two months. It is only after seasonal adjustments – made at the sole discretion of the Bureau of Labor Statistics economists – that 2.9 million fewer jobs gets translated into 446,000 new seasonally adjusted jobs." A 3.3 million "adjustment" solely at the discretion of the BLS? And this from the agency that just admitted it was underestimating the so very critical labor participation rate over the past year? Finally, Biderman wonders whether the BLS is being pressured during an election year to paint an overly optimistic picture by President Obama’s administration in light of these 'real unadjusted job change' facts. Frankly, in light of recent discoveries about the other "impartial" organization, the CBO, we don't think there is any need to wonder at all.

We have examined the nuance of the euphoric jobs data this morning from every angle and by now there should be plenty of 'information' for investors to make their own minds up on its credibility. However, the avuncular CEO of TrimTabs, who despite channeling Lewis Black lately, likely knows this data a little better than the average Jim on the street having collected tax witholdings data for the past 14 years, is modestly apoplectic at the adjustments. In one of his more colorful episodes, and rightfully so, Charles Biderman notes that "Either there is something massively changed in the income tax collection world, or there is something very, very suspicious about today’s BLS hugely positive number," adding, "Actual jobs, not seasonally adjusted, are down 2.9 million over the past two months. It is only after seasonal adjustments – made at the sole discretion of the Bureau of Labor Statistics economists – that 2.9 million fewer jobs gets translated into 446,000 new seasonally adjusted jobs." A 3.3 million "adjustment" solely at the discretion of the BLS? And this from the agency that just admitted it was underestimating the so very critical labor participation rate over the past year? Finally, Biderman wonders whether the BLS is being pressured during an election year to paint an overly optimistic picture by President Obama’s administration in light of these 'real unadjusted job change' facts. Frankly, in light of recent discoveries about the other "impartial" organization, the CBO, we don't think there is any need to wonder at all.Explaining Yesterday's Seasonally Adjusted Nonfarm Payroll "Beat"

Submitted by Tyler Durden on 02/04/2012 - 13:55 BLS Bureau of Labor Statistics Charles Biderman Unemployment Volatility Since there still is confusion regarding yesterday's whopping "surge" in non-farm payrolls, which represented a 243K jump in the Establishment survey (of which 490K was temp jobs, same as in the Household Survey where temp jobs soared by a record 699K), yet only to arrive at an employment number last seen ten years ago, when the US population was about 30 million lower (think about that: 30 million increase in population and no change in the total employed), here is the final explanation of what happened yesterday.

Since there still is confusion regarding yesterday's whopping "surge" in non-farm payrolls, which represented a 243K jump in the Establishment survey (of which 490K was temp jobs, same as in the Household Survey where temp jobs soared by a record 699K), yet only to arrive at an employment number last seen ten years ago, when the US population was about 30 million lower (think about that: 30 million increase in population and no change in the total employed), here is the final explanation of what happened yesterday.

Jim Sinclair’s Commentary

Here is the latest from John Williams’ www.ShadowStats.com.

- Basic Economic Outlook Unaltered by Stronger Labor Data

- January Jobs Reading Still at Levels of 11 Years Ago

- January Unemployment: 8.3% (U.3), 15.1% (U.6), 22.5% (SGS)

- Money Supply M3 Growth Is Picking Up

- January Jobs Reading Still at Levels of 11 Years Ago

- January Unemployment: 8.3% (U.3), 15.1% (U.6), 22.5% (SGS)

- Money Supply M3 Growth Is Picking Up

No. 416: Payrolls, Unemployment and Revisions, M3, PCE Deflator

http://www.shadowstats.com

By Lee Adler, February 3rdEditor’s Note: The earlier version of this article included unadjusted numbers derived from a spreadsheet error. The error resulted in the not seasonally adjusted month to month employment declines being understated. The data has been corrected. The analysis and conclusions are unaffected. Thanks to rdkyote for bringing this to my attention! http://www.shadowstats.com

The headlines are blaring of a massive surge in January employment that blew away analysts expectations. Frankly, I find it hard to believe that any analysts would not have expected this “news.” The real time Federal Withholding Tax daily data for January, which I dutifully cover each week in the Treasury updates, showed a massive surge beginning in late December. Since everybody didn’t get a 10% raise, the analysts might have inferred that more people were working. Whether that’s a sustainable trend or not is another question, but for January at least, there should have been no mystery.

I like to look behind the headlines at the real unadjusted, unmassaged, unmanipulated numbers to get some idea of what’s really going on. Here’s where things get strange. Total reported employment and full time employment plunged in January, as is normal for that month. So the Gummit survey data doesn’t square with the tax collections. Had we based our forecast for the headlines (which is the only thing that matters to the market in the short run) on the withholding data, we would have gotten it right, but for the wrong reasons. It’s a head scratcher that suggests that the Gummit’s employment numbers shouldn’t be trusted, which isn’t news. What we do know for sure is that there was a gigantic surge in withholding taxes from late December to mid January, and that surge disappeared completely in the last week.

Real Withholding Tax Collections Chart- Click to enlarge

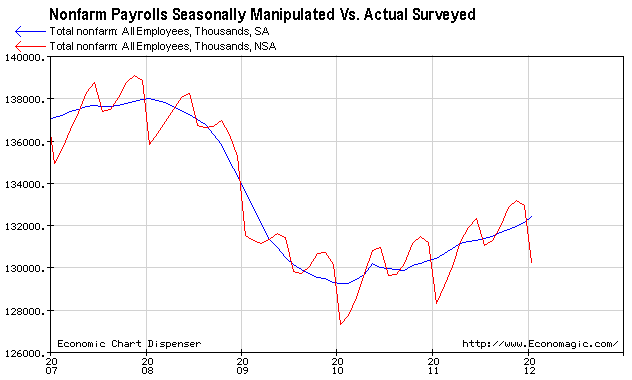

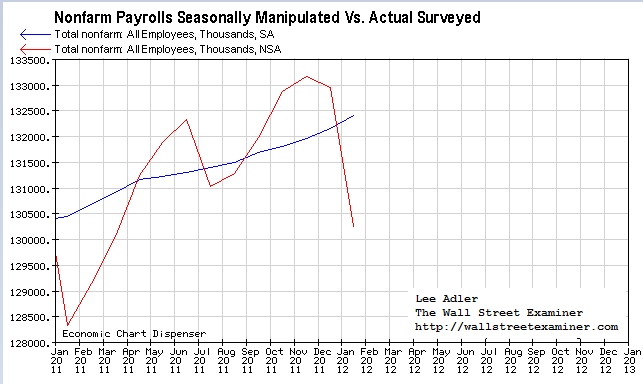

So there’s no question that things were fantastic in January, although why and how that happened is a mystery. Last week’s action suggests that the good news may not persist in February. We also know that the big beat in the headline numbers was an accident. The seasonal adjustment fudge that the Gummit adds to the mix grossly overstated what the actual survey data showed. Here’s a picture. The red line is the actual survey numbers. The blue line is the fake seasonally adjusted number.

Nonfarm Payrolls Chart- Click to Enlarge

Remember: Red… actual. Blue… fake.

Just so you know your eyes aren’t playing tricks on you, let’s zoom in to just the past 13 months.

Nonfarm Payrolls Chart- Click to Enlarge

There you have it. The headline, fake, number was up by 243,000, purportedly the biggest increase since 2006. But what’s this? The actual survey number showed a decrease of 2.7 million jobs. In the world of seasonally adjusted government data, down can be up.

To be honest, that’s a good number for January. Last year the drop was 2.9 million. In 2010 it was also 2.9 million, and in 2009 it was 3.7 million. This year also compares well with the bubble years of 2005 (-2.7 million) and 2006 (-2.7 million). So looking at the top line, the bottom line is that it was a good report, just not the blowout positive number that the headlines reported. It wasn’t a gain, but it was a much smaller loss than in the worst years of the slump, and about as good as any non-recession year.

I like to look at full time employment. There again the seasonal fudging overstated the case. The numbers were not good. Full time jobs declined by 1.2 million in January. That’s worse than last year at 834,000 and 2010 at 1.1 million. But it is better than the 2.6 million drop in 2009 and the 1.7 million drop in 2008. Does that mean this year was just right?

The year to year gain was 1.5 million or just under 1.4%, which was a little less than last year’s 1.5%. Is that a good thing?

Full Time Employment Chart - Click to enlarge

To put this in perspective, the actual survey data says that 111.9 million people had full time jobs in January. That compares with a peak level of 119.3 million in January 2008. They call that a “recovery?”

I wonder whether these numbers can be trusted at all, given the huge surge in withholding taxes in January. From that perspective, the BLS data would seem to understate the gain. But was the gain in taxes really about more jobs, or something else? What was behind that surge in tax collections is a mystery. Apparently, it may have had more to do with bonuses and sales commissions than a big increase in the number of jobs.

There may be a hint of that in the average weekly earnings report which showed a jump of 1.8% between December and January. Apparently some people got big paychecks during the period. I wouldn’t attribute it to a sudden increase in inflation, at least not yet.

In the end, it’s hard to give any of these reports much credence. The blowout headline numbers are misleading, although the tax withholding data showed that some people clearly enjoyed a windfall from late December through the latter part of January. But then that disappeared last week. The chances are that these employment numbers will be heavily revised, and if last week’s tax data is indicative of what’s ahead this month, the “good news” won’t be sustained.

Given the confusion inherent in these numbers, the proof of whether there’s any real improvement in the employment trend may not come until this summer when peak employment levels are normally reached. In 2009, 2010, and 2011, peak full time employment stalled at about the same level each July. This year and last year the seasonal lows have trended upward. So if the economy really is growing, given the running head start off the lows I would expect full time employment to leap past last year’s highs in May or June. If that does not happen, then we have gained nothing. The initial indications will come in the rate of growth in February and March. Those are numbers to watch. If the growth rate holds up, then the economy is growing, but if those growth rates slow, then we’re probably running in quicksand.

Meanwhile, the government’s own survey data show that 7.4 million fewer people have full time jobs today than was the case 4 years ago. Those 7 million jobs were the fake jobs spawned by the housing and credit bubbles. Those jobs were vaporized when the bubble economy collapsed. They are NEVER coming back. The “new normal” is just the old normal without the added froth. What we are left with is the bitter reality of fewer people carrying the tax load and more people needing government assistance. We have yet to see any real proof that the trends are improving enough to ameliorate those burdens on the economy.

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, along with regular updates of the US housing market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW!

The Non-Farm Payrolls Report: Air Brushing History - Nominal Work Force for Nominal GDP

Jesse's Café AméricainWhen a particular person fell out of favor, for example, they not only altered the documents, but even went so far as to air brush them out of important historical photographs.

Today the US reported a remarkably high Non-Farm Payrolls number, well in excess of even the most optimistic estimates. 243,000 jobs added, and unemployment has dropped to only 8.3 percent. Isn't that good news indeed.

If one tracks the data closely, and keeps their own copies of the records, what we see instead are revisions, sometimes going back as far as ten years, that most greatly affect the 'seasonally adjusted' numbers, but also affect the raw numbers as well.

The Obama Administration, as well as the previous Administration, have been going back and tinkering with history, rewriting the numbers here and there, in most cases 'rolling jobs forward' to the current months to make the current headlines look better.

The BLS keeps the digital copies of this and they are duly adjusted of course. But what was surprising in this latest round is that for the first time in my memory they went back and adjusted the Birth-Deal Model, which are imaginary jobs in the first place! And on the web site that I usually check they have stopped providing all the historical data, limiting it to what looks like a year or two of data.

What can one do when the statistics are questionable like this? One common touchstone for those who rely on data is to compare one set of numbers with another, or even with 'real things.' If the sales numbers look great, but unsold inventory is piling up, chances are pretty good that somewhere those sales reports might be disconnected from reality.

One real check I prefer is the Labor Participation Rate. The Census is pretty good about counting the number of people and estimating their growth within some reasonable statistical error. And people do not tend to disappear in large numbers, at least not yet.

Labor Participation is simply the number of people who are working or are unemployed as a percentage of the civilian non-institutionalized population over the age of 16, or simply number of people of working age who are not in prison, etc.

So if the number of people working is increasing and the number of unemployed are decreasing the participation rate *should be increasing* one would think, given the relatively stable growth of the population.

But we instead see that the Labor Participation Rate continues to decline. I am sure the spokesmodels will find some way to try to gloss over this.

Note: The spokemodels and the uninformed parrots quite predictably are tut-tutting this using misdirection by saying that the most recent drop for January alone is attributable to a revision in the Labor Force, the denominator in this case, by the Census Bureau. And I accept that. No problem. But my point again is not to look at a single month, but at the trend, even for this. And from a technical standpoint, the trend here undeniably 'blows.'

If the Fed can target a Nominal GDP, that is, economic growth targets that do not care how much is real and how much is paper manipulation, then I am sure it is only fair for the government to target a Nominal Work Force.

As you know, I do not like to look at these monthly numbers in the first, place, but they are integral to the Wall Street shell game, and the politicians love to play it for the headlines as well.

A more rational approach is to watch the trending average over some reasonable period of time, and to look at multiple sources of data, given the propensity for politicians to stick their fingers in the process.

The problem I have with painting the tape, accounting fraud, and the statistical manipulation of the numbers is that these numbers are the foundation for serious policy decisions. Making January 'look good' is going to make it all the more difficult to take the appropriate political steps to reform the economy and get it working again.

But the Yanks are notoriously short term oriented in their thinking. And this is an election year, and emotions are running high.

I cannot help but think that if the government is finally able to fully digitize money and other assets, all this airbrushing can become so much more simple. Just ask the customers of MF Global. One day you own Treasuries, and even solid bars of gold and silver in your own name, and the next day, poof, they're vaporized. Sorry don't know where they went. Go stand over there in line by the Lost and Found and see what happens.

And so I think we are not in Kansas anymore, Toto. It is looking more like Moscow on the Potomac every day.

Here is a comparison of the Seasonally Adjusted Jobs Numbers before and after the Revisions. Keep in mind that each square represents 100,000 jobs, so even slight changes make a big difference in the headline number which just shows the month over month change.

Again, the point is not that there is some conspiracy, which is how many easily dismiss this, especially the uninformed who want to appear to be 'sophisticates.' Rather it is mean to show that one months data is relatively useless and often misleading, and subject to significant revisions sometimes much later. It is the TREND that matters.

Charles Biderman on the US Non-Farm Payrolls Report

February 5, 2012By Wall Street Examiner Newswires

Larry Summers is a buffoon:

8.3% Unemployment Lie

February 6, 2012, at 12:20 pm

by Greg Hunter in the category USAWatchdog.com |

By Greg Hunter’s USAWatchdog.com

Dear CIGAs,

The most recent unemployment number is a total lie, and that lie was repeated all over the mainstream media (MSM). Two sins were committed here, and I don’t know which one is worse. The report was a sham, and the MSM reported that information without a single question about its accuracy. In a story carried across the MSM spectrum, the Associated Press said, “In a long-awaited surge of hiring, companies added 243,000 jobs in January – across the economy, up and down the pay scale and far more than just about anyone expected. Unemployment fell to 8.3 percent, the lowest in three years.” The report went on to say, “At the same time, the proportion of the population working or looking for work is its lowest in almost three decades. The length and depth of the recession have discouraged millions of people from looking for jobs. The better news of the past couple months has not yet encouraged most of them to start searching again.” (Click here for the complete AP story.)

Here’s a headline for you. If it were not for accounting gimmicks and what the government calls “seasonal-adjustments,” the unemployment rate would have gone up, not down! In his latest report, economist John Williams from Shadowstats.com said, “January’s unadjusted unemployment rate rose to 8.8% . . . The only difference between those numbers and the headline 243,000 January jobs gain and 8.3% unemployment rate, is how the seasonal adjustments were applied. There are serious issues with the current quality of those adjustments, and extremely small distortions in those seasonals can make big differences in the resulting headline data.”

As far as “discouraged” workers who are not looking for a job, that is total rubbish put out by the government. The real story is the Bureau of Labor Statistics (BLS) simply has stopped counting more than 1.2 million of the unemployed in its report Friday. Williams goes on to say, “The issues here suggest that the headline 8.3% unemployment for January has moved well outside the realm of common experience and credibility, into the arena of election-year political shenanigans.” Williams is such a gentleman. Please take into consideration the government’s “official” or “headline” number is only based on people being out of work for 6 months or less. If the unemployment rate was calculated the way BLS did it in 1994 and earlier, the unemployment and underemployment would be 22.5% (according to Shadowstats.com.)

More…

_______________________________

It is noteworthy that NOTHING globally changed fundamentaly Friday, and after a brief surge, the USD finished Friday down 0.07. Yet Gold was whacked for over $30 an ounce? The Global Banking Cartel may down, but they are not out of the Gold [and Silver] rigging business just yet.

Thank you for the sale prices on the Precious Metals!

Got Gold you can hold?

Got Silver you can squeeze?

It is still NOT TOO LATE to accumulate!!!

No comments:

Post a Comment