...and this is why the first three letters of the

word "confidence" spell CON. Its all a CON by the government to convince the

unsuspecting American public that the economy is A-OK! After all, a strong stock market is the sign of a strong economy! Right?

Hardly...

by Plan B Economics

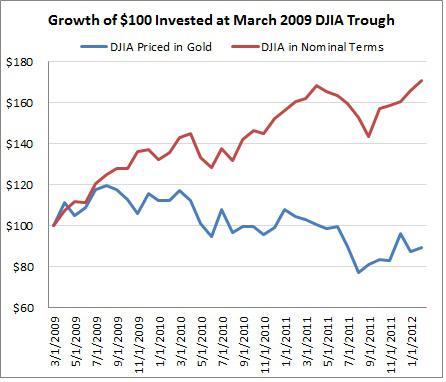

At the same time, we have analysts arguing that Dow 13,000 is a meaningless number. I tend to agree.

Quite simply, some of the biggest stock market booms in history were coupled with the some of the biggest currency devaluations in history. The Weimar Republic and Zimbabwe are two examples that come to mind.

I'm not saying that the US is anywhere close to the Weimar Republic or other hyperinflationary environments (at least, not yet), but the same principles apply. With trillions of dollars injected by central banks into the global financial markets over the past few years, I can't help but think these stock market gains are somewhat diluted. Housing deflation aside, is $1 today what it was at the bottom of the market in March 2009?

With that said, measuring the true value of $1 is quite difficult. After all, CPI is manipulated and various other measures are highly personalized.

One of my preferred proxies for monetary expansion is gold (GLD). When measured in terms of gold, the DJIA has actually fallen by almost 11% since the March 2009 bottom. Compare this to the DJIA in nominal terms, which has risen over 70% during the same time period.

In my opinion, we should be concerned about this massive discrepancy, and celebrating Dow 13,000 may be premature.

____________________________

"The only thing we have to fear is fear itself."

-Franklin D. Roosevelt, First inaugural address, 1932

...but what Americans fear most...IS THE TRUTH!

By Jeff Berwick, The Dollar Vigilante

The first panelist answered 20%. The second panelist said, up to 30%. Then it came to me.

"I have no problem with someone having 100% of their portfolio in gold," I stated bluntly. Many in the crowd laughed. Their laughter confused me. What's so funny about that, I thought?

I went on, "I think it's weird that people find my answer weird."

GOLD IS REAL MONEY

After all, we are talking about time tested and true money. The only money that has lasted for thousands of years and is still fully accepted worldwide as a store of wealth. Even Warren Buffet had to recently admit that “Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.”

And that from a man who hates gold the way Whitney Houston fans hate Bobby Brown.

So, by stating that I have no problem with someone having 100% of their portfolio in gold I am making an ultra conservative statement. I am stating that I'd have no problem with someone having their entire portfolio in "cash". In real money.

What would you rather hold "for eternity"? US dollars? A paper debt obligation of a bankrupt nation state?

The fact that so many found that to be a shocking statement says a lot about where we are in this current process of the collapse of the fiat currency system.

THE FEAR OF GOLD

There is such a "fear of gold" amongst most people that it must be due to statist indoctrination and propaganda. It makes no rational sense to have such a fear of such a time tested and true store of wealth.

The same people who fear gold seem to have no problem holding a significant amount of their assets in euros in a European bank as Europe burns around them, both figuratively and literally. The euro might not exist 12 months from now but no one seems too concerned. They act like its been around forever and always will be, but it only was dreamt up by globalists in 1999.

YOUR BROKER FEARS GOLD

Near the end of 2007 a good friend of mine who had been wanting to sell her house called me. I had been telling her for a few months to sell her house and buy gold because a big housing crash was coming.

She said she had received a good offer for her house and checked with me to make sure I was certain about her selling, buying gold with the proceeds, and renting for a few years. I told her, emphatically, yes.

So she sold her house. At the time gold was around $750 per ounce. We fell out of touch for a few years and she contacted me last year around when gold was near $2,000 per ounce. I smiled when she called, waiting for her to tell me about the fortune she made.

"So?" I asked, waiting for the exhaltation.

"What?" she also asked, confused.

"How'd that trade work out for you?" I asked.

"Oh. Well I sold the house. And I put the funds into my brokerage account with my (government registered) financial advisor," she responded.

My heart sank. I knew what she was going to say.

He talked her out of it. He said putting all her assets into gold was far too risky. Where in the government training manuals does it tell you to even own any gold!

She got worried too and less than a year after selling, under pressure from her old Chinese parents, bought another house. It was a bit cheaper but after transaction and moving costs it was a loss.

GOLD IS IN A BUBBLE

Of course, now, with gold over $1,700, it is nearly impossible to get anyone from the general public to buy gold. It's gone too high, they cry! CNBC says it was a bubble, they repeat like trained seals.

It's gone from near $300 to nearly $2,000 in the last decade. Surely that is a bubble and if it hasn't already popped it soon will, right?

No. That's not right. This is the problem with watching the value of anything in terms of constantly depreciating US Federal Reserve Notes. In the following chart, when looking at the price of gold in nominal dollar terms it looks like an insane rocket ride of epic proportions. But, when adjusted by the US Government's own, heavily massaged inflation statistic (the Consumer Price Index, or CPI), the price of gold has just finally reached nearly the same level it was at in 1980 and looks far less spectacular.

PORTFOLIO ALLOCATIONS

Getting back to the initial question posed on the panel as to what percentage we recommend people hold gold bullion as a percentage of their portfolio. While I stated I'd have no problem with 100%, we actually recommend to TDV subscribers holding 30% of their portfolio in bullion - both gold and silver.

We also recommend, at this time holding 20% of your portfolio in gold mining juniors and 15% in gold mining major stocks amongst other things. That's because we are expecting all the monetary printing going on with abandon in the western world to foment a true bubble, not only in the price of gold but even moreso in the price of the mining shares, especially the juniors.

We are expecting a mania for the ages in these stocks. And, how will we know when to sell? When I am asked what percentage of their portfolio should be held in gold bullion and I say 100% and no one laughs.

___________________________

This next piece is exceptional...and this is why now that this Greece BS is "resolved", its not the Euro that's in trouble in so much as it is the pathetic US Dollar that is doomed...

...of course the mainstream media here in the USA will most likely focus on the debt issues facing Portugal and Spain next...and continue to hide the truth from the "unsuspecting Americans... It's the Fall Of Rome all over again. The Roman citizens were the last to know their currency was worthless, and they were left there asking, "How could this happen?" The exact same thing is happening right now to the USA and the Dollar...but nobody wants to belive it OR admit it. Its called DENIAL.

The noise the media spews about a recovery is sickening...rigged data numbers from "the government"...all to instill "confidence" in the people that the government can, and is, fixing things.

Yeah, ...and monkeys don't eat bananas.

Gold: 1980 vs Today

...of course the mainstream media here in the USA will most likely focus on the debt issues facing Portugal and Spain next...and continue to hide the truth from the "unsuspecting Americans... It's the Fall Of Rome all over again. The Roman citizens were the last to know their currency was worthless, and they were left there asking, "How could this happen?" The exact same thing is happening right now to the USA and the Dollar...but nobody wants to belive it OR admit it. Its called DENIAL.

The noise the media spews about a recovery is sickening...rigged data numbers from "the government"...all to instill "confidence" in the people that the government can, and is, fixing things.

Yeah, ...and monkeys don't eat bananas.

From futuremoneytrends.com , via Zero Hedge

When gold was undergoing its latest (and certainly not greatest) near-parabolic

move last year, there were those pundits consistently calling for comparisons to

1980, and the subsequent gold crash. Yet even a simplistic analysis indicates

that while in the 1980s gold was a hedge to runaway inflation, in the current

deflationary regime, it is a hedge to central planner stupidity that will result

as a response to runaway deflation. In other words, it is a hedge to what

happens when the trillions in central bank reserves (at last check approaching

30% of world GDP). There is much more, and we have explained the nuances

extensively previously, but for those who are only now contemplating the topic

of gold for the first time, the following brief summary from futuremoneytrends.com

captures the salient points. Far more importantly, it also focuses on a

topic that so far has not seen much media focus: the quiet and

pervasive expansion in bilateral

currency agreements which are nothing short of a precursor to dropping the

dollar entirely once enough backup linkages are in place: a situation which will

likely crescendo soon courtesy of upcoming developments in Iran, discussed here

previously.

John Williams of shadowstats.com gave an interview a few weeks ago where he discussed the pending collapse of the U.S. Dollar as the world's reserve currency, as well as the role gold will play going forward.

____________________________

Gold closed today at a new high for 2012 today...

Gas prices are highest ever for this time of year

NEW YORK (AP) -- Gasoline prices have never been higher this time of the year.

At $3.53 a gallon, prices are already up 25 cents since Jan. 1. And experts say they could reach a record $4.25 a gallon by late April.

"You're going to see a lot more staycations this year," says Michael Lynch, president of Strategic Energy & Economic Research. "When the price gets anywhere near $4, you really see people react."

Already, W. Howard Coudle, a retired machinist from Crestwood, Mo., has seen his monthly gasoline bill rise to $80 from about $60 in December. The closest service station is selling regular for $3.39 per gallon, the highest he's ever seen.

"I guess we're going to have to drive less, consolidate all our errands into one trip," Coudle says. "It's just oppressive."

The surge in gas prices follows an increase in the price of oil.

As seen on Zero Hedge

____________________________

Gold closed today at a new high for 2012 today...

Eric King, KingWorldNews.com

On the heels of a Greek bailout, which has gold trading more than

$20 higher and silver back above $34, today King World News interviewed Rick

Rule, CEO of Sprott USA. Rick spoke with KWN about what has just taken place

with Greece and what it means for gold. Here is what Rule had to say: “I

don’t think Greece was bailed out, I think the banks that were stupid enough to

lend Greece money were just bailed out. They have talked about an injection of

fresh cash to maintain Greek living standards. Simultaneously, they have

announced fairly aggressive cuts.”

Rick Rule continues:

“They are aiming at slashing the debt to 120% of GDP

by 2020. This means if you believe that all of the assumptions they made are

correct, then Greek debt will go from unserviceable to barely serviceable by

2020. It’s important to remember that the people who are making these

assumptions are the same people who made the decision to lend money to Greece in

the first place. This lending has Greece 160% in debt vs their GDP.

I suspect that ultimately we are going to see a Greek

default. Right now we are buying time so that more of the private sector and

private banks can unload their Greek paper on the ECB. This will socialize the

losses which have occurred as a result of stupidity on the part of the banks.

As I said earlier, this is a bank bailout, not a bailout of Greece....

“Further, the European community is talking about

increasing its ‘firewall.’ This is the amount of euros it holds in reserves for

difficult times, up to 750 billion euros. Given that none of the European

countries have 750 billion euros floating around that they can move from an

operating account into a rainy day account, one would have to assume this fund

will be funded the same way it was in the US.

What this really means is this will be a printing

facility. So 750 billion euros will be counterfeited in this scheme. We are

just picking on Greece because they are in the headlines, but certainly there

are difficulties in the rest of the economy. Italy, Spain, Portugal, Ireland

and France all have their own problems.

Remember, Eric, that not too long ago Germany had a

failed bond auction. So I don’t think we are out of the woods in Europe. In

this environment the US dollar may remain strong because people are still

focused on Europe. The US problems, while severe, appear to be less time

critical than the European problems. Investors are looking at Europe, but there

is a great deal to be concerned about on the US side as well.”

When asked how all of this will

impact gold, Rule replied, “I think gold will continue to proceed

higher. That doesn’t mean gold can’t have corrections, but much of that

volatility is background noise. Gold competes with fiat currencies as a medium

of exchange and gold competes with sovereign debt claims as a medium of storing

wealth.

Given the fact that all around the world the

sovereigns are busy inflating, that is counterfeiting, it would seem to me that

gold faces no competition. Over time, the depreciation of the competitor has to

favor gold in the two to three year time frame. You know, some value is

afforded by scarcity and certainly with regards to fiat currencies there is no

scarcity.”

___________________________

There's no inflation according to Federal Reserve Chairman Bernanke. The US Dollar is "strong" according Treasury Secretary Geithner. The economy is in a recovery according to President Obama.

By

At $3.53 a gallon, prices are already up 25 cents since Jan. 1. And experts say they could reach a record $4.25 a gallon by late April.

"You're going to see a lot more staycations this year," says Michael Lynch, president of Strategic Energy & Economic Research. "When the price gets anywhere near $4, you really see people react."

Already, W. Howard Coudle, a retired machinist from Crestwood, Mo., has seen his monthly gasoline bill rise to $80 from about $60 in December. The closest service station is selling regular for $3.39 per gallon, the highest he's ever seen.

"I guess we're going to have to drive less, consolidate all our errands into one trip," Coudle says. "It's just oppressive."

The surge in gas prices follows an increase in the price of oil.

__________________________

Wow, gas prices have surged because of a rise in the price of Oil? I wonder if Gold prices have surged because of a rise in the price of Oil?

Got Gold you can hold?

Got Silver you can squeeze?

It's not too late to accumulate!

No comments:

Post a Comment