"Gold is officially replacing the US dollar June 28th. The cat is out of the bag."

-Jim Sinclair, April 23, 2012

I have a question for Ben Bernanke. What if Gold really is money?

From Dave In Denver, The Golden Truth

The Gold Standard Shuffle

What we are witnessing is a sea change in which market forces are driving a de facto return to the gold standard. All that is missing for this to be a de jure gold standard is some regulatory and legal recognition and one has been proposed. The Basel Committee for Bank Supervision, the maker of global capital requirements is studying making gold a bank capital Tier 1 asset. - Professor Lew Spellman, University of Texas from The Spellman Report (link below).

The source of that quote is a must-read essay written by Lew Spellman, who is a professor of finance at the University of Texas of business school. He has also served as Assistant to the Chairman of the President's Council of Economic Advisors and as an economist at the Federal Reserve. It is the latter two prestigious roles which make it both surprising that Professor Spellman would have written this essay and, yet at the same, thereby reinforces its validity. You will not find this piece mentioned in ANY mainstream media news source in this country.

Spellman lays out the case for for the subtle, systemic manner in which gold is slowly creeping back into use by the banking system as an asset being used to back paper currencies and financing transactions. Those of us who study the precious metals markets on a daily basis, in the context of the overall global financial system, have been pointing to this dynamic for a while now. For instance, Spellman links the announcement in which the Basel Committee is studying making gold a Tier 1 banking asset. This was announced several months ago and remarked upon widely in the precious metals community. I doubt anyone's financial adviser called them up to point this out.

The market, along with the massive Central Bank accumulation of gold by China, Russia and several of China's strategic allies - like the other BRIC countries - is starting to force this transformation. I say "the market" because most of the collateral that has been pledged to secure paper financial transactions has been pledged/rehyopothecated (see MF Global, Lehman, Madoff). This is especially true in the repo market where sovereign paper/Treasuries was historically the only asset to be used. Now Central Banks have stretched the range of credibility and extended collateral status to everything except the Brooklyn Bridge (who knows how many times that's been rehypothecated...). The last man standing is gold and it is being forced by the market back into the system as a paper anchor by necessity. Eventually gold will remain as the bastion of "flight to safety" because of its ultimate utility for that purpose.

Everyone needs to read this essay and make sure they understand what is happening and why. Here's the LINK For me, this essay has "seminal" status because it was written by a former "insider" to elite circles - the elite circles which constantly denigrate and revile gold - and because it will likely expose a wider circle of market observers to a systemic dynamic that is taking place with little or no acknowledgement by 99.5% of all market participants.

_______________________

Maybe Ben Bernanke knows Gold is money, but is afraid to admit it. I hope Mr. Spellman sent him a copy of his post below. Gold just may be the ONLY REAL MONEY we have left.

Warren Buffet and the New Calculus of Gold

There has long been a disconnect between gold and institutional investors. The instincts of these managers of large sums are typically tied to the generation of cash flows to feed the monster — that is, the institution’s cash flow needs. Alternative emphasis is given to growth, especially if obligations are long duration and not fixed. This is usually true for pension funds, endowments, some insurance companies or individuals investing for retirement.

For these investors, the preferred investment habitat tends to be a blend of income-generating fixed income and equity type investments that are thought to contain the potential for growth. Because gold, as an investment class, provides neither steady income nor systematic growth, it succeeds in only providing emotional discomfort for these investors.

Warren Buffet’s recent article in Fortune is a reflection of this sentiment. First on the list of asset categories to consider are bonds or, more generally, fixed income. His analysis is instructive.

From his point of view, over the relevant time frame of the 47 years he has been at the helm of Berkshire Hathaway, continuous rolling short term Treasuries bills would have averaged 5.7% annually. But if an investor paid income taxes at a rate averaging 25%, the return is reduced by 1.4 points. Buffet then goes on to point out that the return is then further reduced in real terms by the invisible inflation “tax” which would have devoured the remaining 4.3%. Hence rolling short-term Treasuries would have yielded nothing in real terms.

If one held long maturity Treasuries over this period — which included 30 years of general Treasury bond price appreciation — the investment outcome is questionable if you take into account the declining purchasing power of goods in U.S. dollar terms. It is even worse when compared to a market basket of goods from around the world.

In Buffett’s terms, fixed-dollar investments have fallen a staggering 86% in real dollar value since 1965 during his tenure at Berkshire Hathaway. He points out that today it takes no less than $7 to buy what $1 did when he arrived in Omaha.

He concludes with the recommendation that fixed dollar income investments should come with warning labels advising you that they’re bad for your financial health.

What if contractual steady income doesn’t perform well? Asset categories outside the normal preferred habitat need to be examined. That’s where gold comes in, especially considering that for the first time in our monetary history the central bank has adopted positive inflation as a policy goal. Nonetheless, the institutional sale is a hard one, not just because it’s not been a member of the preferred habitat, but according to Buffet it has other fatal defects.

After conceding in a backhanded way that gold has performed well, with reference to its near $10 trillion in market capitalization, he argues that it doesn’t qualify to be in his preferred investment habitat because it doesn’t produce a growing revenue stream — and if it doesn’t grow, it doesn’t compound.

Rather, he states that his preference would be to employ his capital with growth commodities such as farmland or businesses that will continue to grow its bread-and-butter capacity that can be sold in real terms. That is to say, he rejects gold because it doesn’t produce gold sprouts. Gold is just inert, lying in neatly stacked bars in a subterranean vault. It has but limited use in electronics, jewelry, dentistry and few other applications.

Buffett then goes on to compare the rising price of the sprout-less gold to a Ponzi scheme, which depends upon finding a bigger fool to pay yet a higher price for the same subterranean inert matter. This is apparently proving easier to do by the day as the developed world continues to run outsized fiscal deficits and then compels its central banks to purchase its paper.

Instead, Buffett prefers investments such as Coca-Cola or See’s Candy, which have the ability to sell more candy in the future at the prevailing price level as a means to produce real growth.

That’s where I depart from the Sage of Omaha. While not arguing with the ability of See’s Candy to deliver and the American sweet tooth to be unaffected by the growing concerns for obesity, I believe he fails to see the new product that gold represents and its growing sales potential.

This is “the new calculus of gold.”

In a wealth-accumulating economy there is always demand for an ultimate store of value for wealth preservation. In finance terms, there is always a demand for some asset for which an investor takes no default risk, nor inflation risk, and can be obtained and sold on liquid markets.

For decades, U.S. Treasury debt took over from gold as the market’s preferred store of value. Treasury bonds mythically had no default risk and little inflation risk when central banks were not under pressure to be concerned about unemployment, lending to insolvent banks, or propping up the value of government debt. Moreover, U.S. dollar-denominated Treasuries served not only as the store of value but also sprouted interest payments.

But all that has changed, perhaps not forever but likely for the next four decades, as developed world democratic governments will be under pressure from their constituents to make good on the social contracts of social security and comprehensive health care to the bulging baby boomer population. And, if need be, they will recapture the central banks (by legislative changes if necessary) if they fail to support U.S. Treasury prices.

Given the debt and monetary growth ramifications of these pressures, investors will seek an alternative embodiment of a store of value other than fixed dollar denominated assets, especially sovereigns. With all other developed countries in similar straits and emerging market countries exposed to inflation generation from developed country central banks, their currencies and sovereigns also fail to qualify. Hence, gold has reemerged to play the role of the store of value, despite its sprout-less property. Sprouts are the icing on the cake but not the cake itself — and many gold admirers remember Mark Twain’s old saw: ‘I am more concerned with the return of my money than the return on my money.’

The New Calculus of Gold has much more to its story than merely the market-designated good for inflation and default protection, with or without sprouts.

We are at a historic point in time when both consumer and government debt have grown dramatically relative to income, which is our underlying economic problem (See Roadblocks to Recovery: An Interview with Dr. Lacy Hunt). In the great debt run-up of the last few decades, lenders or bond investors underwrote debt or loans based on either the borrower’s cash flow to service the debt or based on the borrower’s collateral, or both.

But debt has a maturity, and when the maturity is reached, borrowers seek to go back to the well and roll the debt over. From the easy lending days of the turn of the 21st century, the value of what has traditionally been accepted by the lender as good collateral has declined in market value as well as market esteem. That includes residential houses and commercial real estate for mortgages, mortgages for mortgage-backed securities, and mortgage-backed securities for CDOs. Even government securities and guarantees have been questioned especially from abroad when collateral value is set by the credit rating of the collateral. By that measure even U.S. Treasuries and government guarantees fail the test of good collateral given rating downgrades.

Hence, the great corollary of over indebtedness is the relative scarcity of good collateral to support the debt load outstanding. This imbalance of debt to collateral is impacting the ability of banks to make loans to their customers, for central banks to make loans to commercial banks, and for shadow banks to be funded by the overnight Repo market. Hence the growth of gold as a collateral asset to debt heavy markets is inevitably in the cards and is de facto occurring. Gold is stepping up to the plate as “good” collateral in a world of bad collateral.

As described in the accompanying news story (J.P. Morgan to Accept Gold as Collateral), gold is now being accepted (or more likely demanded) as collateral for bank loans, which increases the demand for gold. Furthermore the scarcity of collateral has spread to Europe, where debt is now being priced according to the value of its collateral, and clearing houses are accepting gold as collateral and for exchange settlement. Furthermore in this environment of collateral scarcity, clearing houses that service the shadow banking repo loan closures are closing loans despite the arrival of the collateral (prosaically called settlement fails) but it doesn’t stop the loan from being closed without any collateral, either good or bad and is now causing a regulatory backlash to tighten up actual collateral.

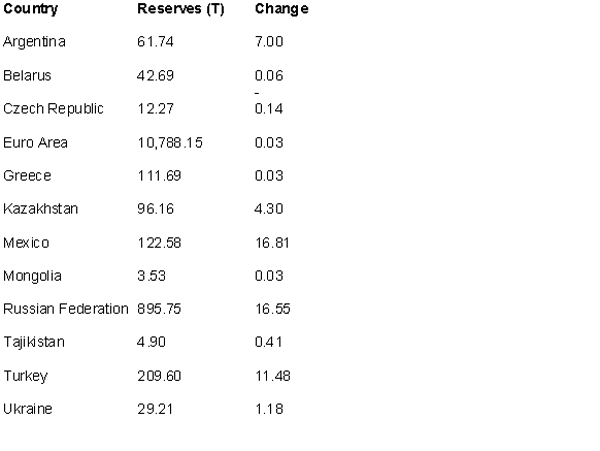

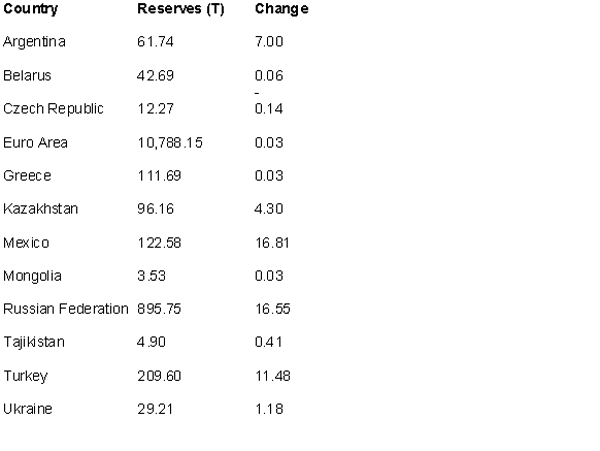

In addition to the demand for gold as collateral to back private debt, there are growing instances of commercial banks and central banks stocking up on gold as assets to meet the perception of depositors that banks or currencies are financially healthy. In this regard there is a shifting of foreign exchange reserves of world central banks away from foreign currency (dollars) into gold as shown in the Figure.

Most importantly, China, in its not so secret desire for the Yuan to be a world reserve currency, is accumulating domestically produced gold as it bans exportation, and at the same time it is shifting its foreign exchange reserves from currency into gold. If the Yuan has a chance to have reserve currency status it likely would require gold backing. A gold-backed Yuan would make a big dent in the U.S. market for the dollar and Treasuries as the world’s store of value asset. A gold-backed Yuan would be the equivalent of gold certificates in a warehouse and denominated in a currency that would be on the upswing and very desirable as compared to developed country sovereigns or currency. It might even be more appealing than gold certificates stored in a Swiss warehouse, denominated in a currency that is not allowed by its central bank to appreciate.

Most importantly, China, in its not so secret desire for the Yuan to be a world reserve currency, is accumulating domestically produced gold as it bans exportation, and at the same time it is shifting its foreign exchange reserves from currency into gold. If the Yuan has a chance to have reserve currency status it likely would require gold backing. A gold-backed Yuan would make a big dent in the U.S. market for the dollar and Treasuries as the world’s store of value asset. A gold-backed Yuan would be the equivalent of gold certificates in a warehouse and denominated in a currency that would be on the upswing and very desirable as compared to developed country sovereigns or currency. It might even be more appealing than gold certificates stored in a Swiss warehouse, denominated in a currency that is not allowed by its central bank to appreciate.

We have entered an environment with elevated debt to collateral and elevated currency to goods, and gold is again demanded by market forces to enhance the value of debt paper and otherwise fiat currency.

What we are witnessing is a sea change in which market forces are driving a de facto return to the gold standard. All that is missing for this to be a de jure gold standard is some regulatory and legal recognition and one has been proposed. The Basel Committee for Bank Supervision, the maker of global capital requirements is studying making gold a bank capital Tier 1 asset.

This implies banks would be regulatory blessed to operate with less equity capital than is normally required of banks if they held more gold as an asset. Basically, regulators would allow banks to be more leveraged, meaning the banks would not suffer as much equity dilution to recapitalize after sovereign and mortgage write downs. Not only would gold then be backstopping debt and currency but also be backstopping bank equity capital. So the realm of gold is expanding to fill the void of other “money good” assets and elevating its demand.

The world has gravitated from one gold-backed paper currency to another before, and it likely is happening again. It would depend on whether investors in liquid, default-free, inflation-free paper prefer gold-backed Chinese Yuan to Swiss warehouse receipts or deposits from large international banks with large gold positions that operate with lots of leverage. This is a market choice that will determine the gold linked paper store of value, but the point is that all the paper contenders derive value from the gold backing, and thereby expands the demand for the shiny metal. This is the new calculus of gold. This state of affairs is likely to remain until developed world governments no longer reach for the unreachable and pressure their central banks to finance it.

If you enjoy this blog, please forward it to others who may be interested.

_______________________

Clearly Ben, Gold has been and will soon again be MONEY. In many ways the entire WORLD can thank you, Ben, for returning Gold to it's rightful place as an "honest" store of value and the lone insurance mechanism of wealth.

Ben, those IOUs you call Federal Reserve Notes have been hoot. It's been all fun and games... until now. What happens when all that paper money of yours falls into the "abyss of worthlessness"?

Guest Post: What Happens When All The Money Vanishes Into Thin Air?

From ZeroHedge

It's easy to expand the money supply and difficult to expand the actual production of real goods in the real world. Expanding the money supply and issuing debt that lacks collateral is just like printing quatloos on the desert island: you can print a million quatloos but that doesn't create a single additional coconut. If you print enough quatloos, then people will no longer accept them in exchange for coconuts. You will actually need a real coconut to exchange for fish. This is why Greek towns are reportedly reverting to barter, the exchange of real goods for other real goods. We can anticipate that silver and gold will soon enter the barter as means of exchange that can't be counterfeited or printed by wise-guys (central bankers).This is what happens when abstract representations, i.e. "money," vanish into thin air. Alternative systems of exchanging goods and services arise: actual goods are exchanged via barter, tangible concentrations of value that cannot be counterfeited such as gold and silver are used as a means of exchange, letters of credit or equivalent are traded and settled with tangible goods or gold/silver, and eventually, a means of exchange ("money") that is backed by tangible goods in the real world that can be trusted to actually represent the value being traded might enter the market. That which is phantom will vanish into thin air, while the real goods and services remain to be traded in the real world.

Please read more

_______________________

Jeepers Ben! What will happen if all your "money" vanishes into thin air? How will people buy the things they NEED? Like energy for instance. Could they possible buy Oil with Gold instead of your "money"?

The Best Reason in the World to Buy Gold

By Gordon G. Chang

On the last day of 2011, President Obama signed the National Defense Authorization Act for Fiscal Year 2012. The NDAA, as it is called, attempts to reduce Iran’s revenue from the sale of petroleum by imposing sanctions on foreign financial institutions conducting transactions with Iranian financial institutions in connection with those sales. This provision, which essentially cuts off sanctioned institutions from the U.S. financial system, takes effect on June 28.

So how can Beijing keep both Iran’s ayatollahs and President Obama happy at the same time? Simple, the Chinese can avoid the U.S. sanctions through barter. China has already been trading its produce for Iran’s petroleum, but there is only so much gai lan and bok choy the Iranians can eat. That’s why Iran is also accepting, among other goods, Chinese washing machines, refrigerators, toys, clothes, cosmetics, and toiletries.

The barter trade works, but Iran needs cash too. As it is being cut off from the global financial system, the next best thing is gold. So we should not be surprised that in late February the Iranian central bank said it would accept that metal as payment for oil. Last year, China imported $21.7 billion in Iranian oil and exported $14.8 billion in goods and services. As the NDAA goes into effect, look for Beijing to ship gold to Iran to make up the difference.

Please read more

_______________________

The Implications Of China Paying In Gold

April 23, 2012, at 5:09 pm

by Jim Sinclair

Dear CIGAs,

The implications of China paying for Iranian oil in gold is the most important event in the modern history of gold

1. It is reasonable to assume that China has been threatened with total or at least selective exclusion from the SWIFT system if it pays in any currency for Iranian oil.

2. Gold has been decided by China as the means of making payment for massive international purchases free of the SWIFT system.

3. Other Asian and Middle Eastern nations will now see the gold they hold as money free of Western economic interference.

4. Gold now is not only money free of liability, but also free from interference regarding settlement by the long arm of Western influence.

5. The SWIFT system is becoming ever more a weapon of Western international political will.

6. In case of war anywhere, it is now demonstrated for all to see that only gold will buy the materials required. Paper currencies are under the SWIFT system’s control in settlement.

7. Far from being a barbaric relic, gold is now clearly the money of state survival in every sense.

8. It is reasonable and possible for the supply of physical gold to fall far behind the size of the massive short positions now common to algorithm and hedge fund paper shorts. That will make an effective cover at a reasonable price as compared to a certain day’s close impossible the following day on an exogenous event.

9. It may not be possible to use TA of any nature to determine a price of overvaluation for gold. Should the USA decide to take on China in full out economic war with the physical market totally illiquid, such as through isolation from the SWIFT system, consider the gold price that might result.

_______________________

For more on the SWIFT electronic payments system:

Society for Worldwide Interbank Financial Telecommunication

India to buy Iran oil in Gold not Dollars

Posted by EU Times on Jan 24th

India has agreed to pay the price of crude oil it imports from Iran in gold, which makes it the first country to drop the US dollar for purchasing the Iranian oil.

According to a report published by DEBKAfile news website, unnamed sources have stressed that China is also expected to follow suit.

India and China take about one million barrels per day (bpd), or 40 percent of Iran’s total exports of 2.5 million bpd and both of them have huge reserves of gold.

The report added that by trading in gold, New Delhi and Beijing enable Tehran to bypass the upcoming freeze on its Central Bank’s assets and the oil embargo which the European Union’s foreign ministers agreed to impose on Monday, January 23.

The EU currently buys around 20 percent of Iran’s oil exports.

On the other hand, experts say the vast sums involved in these transactions are expected to boost the price of gold and depress the value of the dollar on world markets.

“An Indian delegation visited Tehran last week to discuss payment options in view of the new sanctions. The two sides were reported to have agreed that payment for the oil purchased would be partly in yen and partly in rupees. The switch to gold was kept [in the] dark,” the report stated.

India is Iran’s second largest customer after China, and purchases around USD 12-billion-a-year worth of Iranian crude, or about 12 percent of its consumption.

Delhi is to execute its transactions, the report said, through two state-owned banks: the Calcutta-based UCO Bank, whose board of directors is made up of the Indian government, the Reserve Bank of India representatives, and Halk Bankasi (Peoples Bank) — Turkey’s seventh largest bank which is owned by the government.

US President Barack Obama signed into law, on December 31, 2011, new sanctions which seek to penalize other countries for importing Iran’s oil or doing transaction with Islamic Republic’s Central Bank.

Foreign ministers of the European Union also imposed sanctions on Iran’s oil imports over the country’s peaceful nuclear program during their Monday meeting in Brussels.

The sanctions involve an immediate ban on all new oil contracts with Iran and a freeze on the assets of the country’s Central Bank within the EU.

Tehran has warned that the embargo will have negative consequences, such as increasing the oil price.

-Jim Sinclair, April 23, 2012

I have a question for Ben Bernanke. What if Gold really is money?

From Dave In Denver, The Golden Truth

The Gold Standard Shuffle

What we are witnessing is a sea change in which market forces are driving a de facto return to the gold standard. All that is missing for this to be a de jure gold standard is some regulatory and legal recognition and one has been proposed. The Basel Committee for Bank Supervision, the maker of global capital requirements is studying making gold a bank capital Tier 1 asset. - Professor Lew Spellman, University of Texas from The Spellman Report (link below).

The source of that quote is a must-read essay written by Lew Spellman, who is a professor of finance at the University of Texas of business school. He has also served as Assistant to the Chairman of the President's Council of Economic Advisors and as an economist at the Federal Reserve. It is the latter two prestigious roles which make it both surprising that Professor Spellman would have written this essay and, yet at the same, thereby reinforces its validity. You will not find this piece mentioned in ANY mainstream media news source in this country.

Spellman lays out the case for for the subtle, systemic manner in which gold is slowly creeping back into use by the banking system as an asset being used to back paper currencies and financing transactions. Those of us who study the precious metals markets on a daily basis, in the context of the overall global financial system, have been pointing to this dynamic for a while now. For instance, Spellman links the announcement in which the Basel Committee is studying making gold a Tier 1 banking asset. This was announced several months ago and remarked upon widely in the precious metals community. I doubt anyone's financial adviser called them up to point this out.

The market, along with the massive Central Bank accumulation of gold by China, Russia and several of China's strategic allies - like the other BRIC countries - is starting to force this transformation. I say "the market" because most of the collateral that has been pledged to secure paper financial transactions has been pledged/rehyopothecated (see MF Global, Lehman, Madoff). This is especially true in the repo market where sovereign paper/Treasuries was historically the only asset to be used. Now Central Banks have stretched the range of credibility and extended collateral status to everything except the Brooklyn Bridge (who knows how many times that's been rehypothecated...). The last man standing is gold and it is being forced by the market back into the system as a paper anchor by necessity. Eventually gold will remain as the bastion of "flight to safety" because of its ultimate utility for that purpose.

Everyone needs to read this essay and make sure they understand what is happening and why. Here's the LINK For me, this essay has "seminal" status because it was written by a former "insider" to elite circles - the elite circles which constantly denigrate and revile gold - and because it will likely expose a wider circle of market observers to a systemic dynamic that is taking place with little or no acknowledgement by 99.5% of all market participants.

_______________________

Maybe Ben Bernanke knows Gold is money, but is afraid to admit it. I hope Mr. Spellman sent him a copy of his post below. Gold just may be the ONLY REAL MONEY we have left.

Warren Buffet and the New Calculus of Gold

There has long been a disconnect between gold and institutional investors. The instincts of these managers of large sums are typically tied to the generation of cash flows to feed the monster — that is, the institution’s cash flow needs. Alternative emphasis is given to growth, especially if obligations are long duration and not fixed. This is usually true for pension funds, endowments, some insurance companies or individuals investing for retirement.

For these investors, the preferred investment habitat tends to be a blend of income-generating fixed income and equity type investments that are thought to contain the potential for growth. Because gold, as an investment class, provides neither steady income nor systematic growth, it succeeds in only providing emotional discomfort for these investors.

Warren Buffet’s recent article in Fortune is a reflection of this sentiment. First on the list of asset categories to consider are bonds or, more generally, fixed income. His analysis is instructive.

From his point of view, over the relevant time frame of the 47 years he has been at the helm of Berkshire Hathaway, continuous rolling short term Treasuries bills would have averaged 5.7% annually. But if an investor paid income taxes at a rate averaging 25%, the return is reduced by 1.4 points. Buffet then goes on to point out that the return is then further reduced in real terms by the invisible inflation “tax” which would have devoured the remaining 4.3%. Hence rolling short-term Treasuries would have yielded nothing in real terms.

If one held long maturity Treasuries over this period — which included 30 years of general Treasury bond price appreciation — the investment outcome is questionable if you take into account the declining purchasing power of goods in U.S. dollar terms. It is even worse when compared to a market basket of goods from around the world.

In Buffett’s terms, fixed-dollar investments have fallen a staggering 86% in real dollar value since 1965 during his tenure at Berkshire Hathaway. He points out that today it takes no less than $7 to buy what $1 did when he arrived in Omaha.

He concludes with the recommendation that fixed dollar income investments should come with warning labels advising you that they’re bad for your financial health.

What if contractual steady income doesn’t perform well? Asset categories outside the normal preferred habitat need to be examined. That’s where gold comes in, especially considering that for the first time in our monetary history the central bank has adopted positive inflation as a policy goal. Nonetheless, the institutional sale is a hard one, not just because it’s not been a member of the preferred habitat, but according to Buffet it has other fatal defects.

After conceding in a backhanded way that gold has performed well, with reference to its near $10 trillion in market capitalization, he argues that it doesn’t qualify to be in his preferred investment habitat because it doesn’t produce a growing revenue stream — and if it doesn’t grow, it doesn’t compound.

Rather, he states that his preference would be to employ his capital with growth commodities such as farmland or businesses that will continue to grow its bread-and-butter capacity that can be sold in real terms. That is to say, he rejects gold because it doesn’t produce gold sprouts. Gold is just inert, lying in neatly stacked bars in a subterranean vault. It has but limited use in electronics, jewelry, dentistry and few other applications.

Buffett then goes on to compare the rising price of the sprout-less gold to a Ponzi scheme, which depends upon finding a bigger fool to pay yet a higher price for the same subterranean inert matter. This is apparently proving easier to do by the day as the developed world continues to run outsized fiscal deficits and then compels its central banks to purchase its paper.

Instead, Buffett prefers investments such as Coca-Cola or See’s Candy, which have the ability to sell more candy in the future at the prevailing price level as a means to produce real growth.

That’s where I depart from the Sage of Omaha. While not arguing with the ability of See’s Candy to deliver and the American sweet tooth to be unaffected by the growing concerns for obesity, I believe he fails to see the new product that gold represents and its growing sales potential.

This is “the new calculus of gold.”

In a wealth-accumulating economy there is always demand for an ultimate store of value for wealth preservation. In finance terms, there is always a demand for some asset for which an investor takes no default risk, nor inflation risk, and can be obtained and sold on liquid markets.

For decades, U.S. Treasury debt took over from gold as the market’s preferred store of value. Treasury bonds mythically had no default risk and little inflation risk when central banks were not under pressure to be concerned about unemployment, lending to insolvent banks, or propping up the value of government debt. Moreover, U.S. dollar-denominated Treasuries served not only as the store of value but also sprouted interest payments.

But all that has changed, perhaps not forever but likely for the next four decades, as developed world democratic governments will be under pressure from their constituents to make good on the social contracts of social security and comprehensive health care to the bulging baby boomer population. And, if need be, they will recapture the central banks (by legislative changes if necessary) if they fail to support U.S. Treasury prices.

Given the debt and monetary growth ramifications of these pressures, investors will seek an alternative embodiment of a store of value other than fixed dollar denominated assets, especially sovereigns. With all other developed countries in similar straits and emerging market countries exposed to inflation generation from developed country central banks, their currencies and sovereigns also fail to qualify. Hence, gold has reemerged to play the role of the store of value, despite its sprout-less property. Sprouts are the icing on the cake but not the cake itself — and many gold admirers remember Mark Twain’s old saw: ‘I am more concerned with the return of my money than the return on my money.’

The New Calculus of Gold has much more to its story than merely the market-designated good for inflation and default protection, with or without sprouts.

We are at a historic point in time when both consumer and government debt have grown dramatically relative to income, which is our underlying economic problem (See Roadblocks to Recovery: An Interview with Dr. Lacy Hunt). In the great debt run-up of the last few decades, lenders or bond investors underwrote debt or loans based on either the borrower’s cash flow to service the debt or based on the borrower’s collateral, or both.

But debt has a maturity, and when the maturity is reached, borrowers seek to go back to the well and roll the debt over. From the easy lending days of the turn of the 21st century, the value of what has traditionally been accepted by the lender as good collateral has declined in market value as well as market esteem. That includes residential houses and commercial real estate for mortgages, mortgages for mortgage-backed securities, and mortgage-backed securities for CDOs. Even government securities and guarantees have been questioned especially from abroad when collateral value is set by the credit rating of the collateral. By that measure even U.S. Treasuries and government guarantees fail the test of good collateral given rating downgrades.

Hence, the great corollary of over indebtedness is the relative scarcity of good collateral to support the debt load outstanding. This imbalance of debt to collateral is impacting the ability of banks to make loans to their customers, for central banks to make loans to commercial banks, and for shadow banks to be funded by the overnight Repo market. Hence the growth of gold as a collateral asset to debt heavy markets is inevitably in the cards and is de facto occurring. Gold is stepping up to the plate as “good” collateral in a world of bad collateral.

As described in the accompanying news story (J.P. Morgan to Accept Gold as Collateral), gold is now being accepted (or more likely demanded) as collateral for bank loans, which increases the demand for gold. Furthermore the scarcity of collateral has spread to Europe, where debt is now being priced according to the value of its collateral, and clearing houses are accepting gold as collateral and for exchange settlement. Furthermore in this environment of collateral scarcity, clearing houses that service the shadow banking repo loan closures are closing loans despite the arrival of the collateral (prosaically called settlement fails) but it doesn’t stop the loan from being closed without any collateral, either good or bad and is now causing a regulatory backlash to tighten up actual collateral.

In addition to the demand for gold as collateral to back private debt, there are growing instances of commercial banks and central banks stocking up on gold as assets to meet the perception of depositors that banks or currencies are financially healthy. In this regard there is a shifting of foreign exchange reserves of world central banks away from foreign currency (dollars) into gold as shown in the Figure.

Most importantly, China, in its not so secret desire for the Yuan to be a world reserve currency, is accumulating domestically produced gold as it bans exportation, and at the same time it is shifting its foreign exchange reserves from currency into gold. If the Yuan has a chance to have reserve currency status it likely would require gold backing. A gold-backed Yuan would make a big dent in the U.S. market for the dollar and Treasuries as the world’s store of value asset. A gold-backed Yuan would be the equivalent of gold certificates in a warehouse and denominated in a currency that would be on the upswing and very desirable as compared to developed country sovereigns or currency. It might even be more appealing than gold certificates stored in a Swiss warehouse, denominated in a currency that is not allowed by its central bank to appreciate.

Most importantly, China, in its not so secret desire for the Yuan to be a world reserve currency, is accumulating domestically produced gold as it bans exportation, and at the same time it is shifting its foreign exchange reserves from currency into gold. If the Yuan has a chance to have reserve currency status it likely would require gold backing. A gold-backed Yuan would make a big dent in the U.S. market for the dollar and Treasuries as the world’s store of value asset. A gold-backed Yuan would be the equivalent of gold certificates in a warehouse and denominated in a currency that would be on the upswing and very desirable as compared to developed country sovereigns or currency. It might even be more appealing than gold certificates stored in a Swiss warehouse, denominated in a currency that is not allowed by its central bank to appreciate.We have entered an environment with elevated debt to collateral and elevated currency to goods, and gold is again demanded by market forces to enhance the value of debt paper and otherwise fiat currency.

What we are witnessing is a sea change in which market forces are driving a de facto return to the gold standard. All that is missing for this to be a de jure gold standard is some regulatory and legal recognition and one has been proposed. The Basel Committee for Bank Supervision, the maker of global capital requirements is studying making gold a bank capital Tier 1 asset.

This implies banks would be regulatory blessed to operate with less equity capital than is normally required of banks if they held more gold as an asset. Basically, regulators would allow banks to be more leveraged, meaning the banks would not suffer as much equity dilution to recapitalize after sovereign and mortgage write downs. Not only would gold then be backstopping debt and currency but also be backstopping bank equity capital. So the realm of gold is expanding to fill the void of other “money good” assets and elevating its demand.

The world has gravitated from one gold-backed paper currency to another before, and it likely is happening again. It would depend on whether investors in liquid, default-free, inflation-free paper prefer gold-backed Chinese Yuan to Swiss warehouse receipts or deposits from large international banks with large gold positions that operate with lots of leverage. This is a market choice that will determine the gold linked paper store of value, but the point is that all the paper contenders derive value from the gold backing, and thereby expands the demand for the shiny metal. This is the new calculus of gold. This state of affairs is likely to remain until developed world governments no longer reach for the unreachable and pressure their central banks to finance it.

If you enjoy this blog, please forward it to others who may be interested.

_______________________

Clearly Ben, Gold has been and will soon again be MONEY. In many ways the entire WORLD can thank you, Ben, for returning Gold to it's rightful place as an "honest" store of value and the lone insurance mechanism of wealth.

Ben, those IOUs you call Federal Reserve Notes have been hoot. It's been all fun and games... until now. What happens when all that paper money of yours falls into the "abyss of worthlessness"?

Guest Post: What Happens When All The Money Vanishes Into Thin Air?

From ZeroHedge

It's easy to expand the money supply and difficult to expand the actual production of real goods in the real world. Expanding the money supply and issuing debt that lacks collateral is just like printing quatloos on the desert island: you can print a million quatloos but that doesn't create a single additional coconut. If you print enough quatloos, then people will no longer accept them in exchange for coconuts. You will actually need a real coconut to exchange for fish. This is why Greek towns are reportedly reverting to barter, the exchange of real goods for other real goods. We can anticipate that silver and gold will soon enter the barter as means of exchange that can't be counterfeited or printed by wise-guys (central bankers).This is what happens when abstract representations, i.e. "money," vanish into thin air. Alternative systems of exchanging goods and services arise: actual goods are exchanged via barter, tangible concentrations of value that cannot be counterfeited such as gold and silver are used as a means of exchange, letters of credit or equivalent are traded and settled with tangible goods or gold/silver, and eventually, a means of exchange ("money") that is backed by tangible goods in the real world that can be trusted to actually represent the value being traded might enter the market. That which is phantom will vanish into thin air, while the real goods and services remain to be traded in the real world.

Please read more

_______________________

Jeepers Ben! What will happen if all your "money" vanishes into thin air? How will people buy the things they NEED? Like energy for instance. Could they possible buy Oil with Gold instead of your "money"?

The Best Reason in the World to Buy Gold

By Gordon G. Chang

Beijing is planning to avoid U.S. financial

sanctions on Iran by paying for oil with gold. China’s imports of the metal are

already

large, and you can guess what additional purchases are going to do to

prices.

On the last day of 2011, President Obama signed the National Defense Authorization Act for Fiscal Year 2012. The NDAA, as it is called, attempts to reduce Iran’s revenue from the sale of petroleum by imposing sanctions on foreign financial institutions conducting transactions with Iranian financial institutions in connection with those sales. This provision, which essentially cuts off sanctioned institutions from the U.S. financial system, takes effect on June 28.

The NDAA gives the president the power to waive

the sanctions depending on the availability and price of supplies from

non-Iranian sources. He can also exempt financial institutions from countries

that have significantly cut back purchases of Iranian petroleum. Last month,

the State Department announced waivers for Japan and ten European countries.

China, which has received American waivers in the past under other Iran

legislation, is now Tehran’s largest oil customer and investor as well as its

largest trading partner. Given the new mood in Washington, Beijing

cannot count on getting more exceptions in the future.

As the Wall Street Journal noted

in early January, the sanctions are “an attempt to force other countries to

choose between buying oil from Iran or being blocked from any dealings with the

U.S. economy.” The strict measures put Chinese officials in a bind. They

apparently believe their geopolitical interests align with those of Tehran, but

their economy is becoming increasingly

reliant on America’s.

So how can Beijing keep both Iran’s ayatollahs and President Obama happy at the same time? Simple, the Chinese can avoid the U.S. sanctions through barter. China has already been trading its produce for Iran’s petroleum, but there is only so much gai lan and bok choy the Iranians can eat. That’s why Iran is also accepting, among other goods, Chinese washing machines, refrigerators, toys, clothes, cosmetics, and toiletries.

The barter trade works, but Iran needs cash too. As it is being cut off from the global financial system, the next best thing is gold. So we should not be surprised that in late February the Iranian central bank said it would accept that metal as payment for oil. Last year, China imported $21.7 billion in Iranian oil and exported $14.8 billion in goods and services. As the NDAA goes into effect, look for Beijing to ship gold to Iran to make up the difference.

Please read more

_______________________

The Implications Of China Paying In Gold

April 23, 2012, at 5:09 pm

by Jim Sinclair

Dear CIGAs,

The implications of China paying for Iranian oil in gold is the most important event in the modern history of gold

1. It is reasonable to assume that China has been threatened with total or at least selective exclusion from the SWIFT system if it pays in any currency for Iranian oil.

2. Gold has been decided by China as the means of making payment for massive international purchases free of the SWIFT system.

3. Other Asian and Middle Eastern nations will now see the gold they hold as money free of Western economic interference.

4. Gold now is not only money free of liability, but also free from interference regarding settlement by the long arm of Western influence.

5. The SWIFT system is becoming ever more a weapon of Western international political will.

6. In case of war anywhere, it is now demonstrated for all to see that only gold will buy the materials required. Paper currencies are under the SWIFT system’s control in settlement.

7. Far from being a barbaric relic, gold is now clearly the money of state survival in every sense.

8. It is reasonable and possible for the supply of physical gold to fall far behind the size of the massive short positions now common to algorithm and hedge fund paper shorts. That will make an effective cover at a reasonable price as compared to a certain day’s close impossible the following day on an exogenous event.

9. It may not be possible to use TA of any nature to determine a price of overvaluation for gold. Should the USA decide to take on China in full out economic war with the physical market totally illiquid, such as through isolation from the SWIFT system, consider the gold price that might result.

_______________________

For more on the SWIFT electronic payments system:

Society for Worldwide Interbank Financial Telecommunication

From Wikipedia, the free encyclopedia

_______________________

April 24, 2012, at 12:17 am

by Jim Sinclair

Dear CIGAs,

To better understand what China offers to gold, lets reverse the situation. Let us say that China has a means of interfering with the USA’s trade cash settlement mechanism and has threatened to use this interference in order to influence the United States to take such action that the USA does not necessarily wish. The United States announces that on June 28th, more than likely a deadline China has given in this reverse scenario, that the USA will settle all our imported energy costs from Saudi Arabia in gold rather than any other currency.

Consider how important that would be to gold. Think what this means to confidence in the fiat currency. We are not talking about a small meaningless country; we are talking about the two economic giants on the planet Earth. This is China versus the USA with the thrust being the SWIFT system and the parry being gold bullion.

This is history in the making. This is monetization of gold brought on as a parry to the trust of economic attack via the weapon, the SWIFT system. This is certainly economic war. It may well be an aggressive act that will change the economic world as we know it. It may be Phil that you have not thought out the implications of using the SWIFT system as a weapon. There is a huge backfire probable at a most unwelcome time in economic history.

by Jim Sinclair

Dear CIGAs,

To better understand what China offers to gold, lets reverse the situation. Let us say that China has a means of interfering with the USA’s trade cash settlement mechanism and has threatened to use this interference in order to influence the United States to take such action that the USA does not necessarily wish. The United States announces that on June 28th, more than likely a deadline China has given in this reverse scenario, that the USA will settle all our imported energy costs from Saudi Arabia in gold rather than any other currency.

Consider how important that would be to gold. Think what this means to confidence in the fiat currency. We are not talking about a small meaningless country; we are talking about the two economic giants on the planet Earth. This is China versus the USA with the thrust being the SWIFT system and the parry being gold bullion.

This is history in the making. This is monetization of gold brought on as a parry to the trust of economic attack via the weapon, the SWIFT system. This is certainly economic war. It may well be an aggressive act that will change the economic world as we know it. It may be Phil that you have not thought out the implications of using the SWIFT system as a weapon. There is a huge backfire probable at a most unwelcome time in economic history.

_______________________

Recall this news flash back in January of this year? China is NOT the only country interested in paying for Iranian Oil with Gold:

India to buy Iran oil in Gold not Dollars

Posted by EU Times on Jan 24th

India has agreed to pay the price of crude oil it imports from Iran in gold, which makes it the first country to drop the US dollar for purchasing the Iranian oil.

According to a report published by DEBKAfile news website, unnamed sources have stressed that China is also expected to follow suit.

India and China take about one million barrels per day (bpd), or 40 percent of Iran’s total exports of 2.5 million bpd and both of them have huge reserves of gold.

The report added that by trading in gold, New Delhi and Beijing enable Tehran to bypass the upcoming freeze on its Central Bank’s assets and the oil embargo which the European Union’s foreign ministers agreed to impose on Monday, January 23.

The EU currently buys around 20 percent of Iran’s oil exports.

On the other hand, experts say the vast sums involved in these transactions are expected to boost the price of gold and depress the value of the dollar on world markets.

“An Indian delegation visited Tehran last week to discuss payment options in view of the new sanctions. The two sides were reported to have agreed that payment for the oil purchased would be partly in yen and partly in rupees. The switch to gold was kept [in the] dark,” the report stated.

India is Iran’s second largest customer after China, and purchases around USD 12-billion-a-year worth of Iranian crude, or about 12 percent of its consumption.

Delhi is to execute its transactions, the report said, through two state-owned banks: the Calcutta-based UCO Bank, whose board of directors is made up of the Indian government, the Reserve Bank of India representatives, and Halk Bankasi (Peoples Bank) — Turkey’s seventh largest bank which is owned by the government.

US President Barack Obama signed into law, on December 31, 2011, new sanctions which seek to penalize other countries for importing Iran’s oil or doing transaction with Islamic Republic’s Central Bank.

Foreign ministers of the European Union also imposed sanctions on Iran’s oil imports over the country’s peaceful nuclear program during their Monday meeting in Brussels.

The sanctions involve an immediate ban on all new oil contracts with Iran and a freeze on the assets of the country’s Central Bank within the EU.

Tehran has warned that the embargo will have negative consequences, such as increasing the oil price.

_____________________

The price of WTI Oil on January 23, 2012 was $101. Oil has since risen up to $111, and today is at $103.50.

China and India lead the WORLD in annual Gold purchases, but they are not alone:

From ZeroHedge

While gold demand from the western investors and store of wealth buyers has fallen in recent months, central bank demand continues to be very robust and this is providing strong support to gold above the $1,600/oz level.

IMF data released overnight shows that Mexico added 16.8 metric tons of gold valued at about $906.4 million to its reserves in March.

Russia continued to diversify its foreign exchange reserves and increased its gold reserves by about 16.5 tons according to a statement by its central bank on April 20.

Changes to Gold Holdings in IMF (March) - Reuters Global Gold Forum

Other creditor nations with large foreign exchange reserves and exposure to the dollar and the euro including Turkey and Kazakhstan also increased their holdings of gold according to the International Monetary Fund data.

Mexico raised its reserves to 122.6 tons last month when gold averaged $1,676.67 an ounce.

Turkey added 11.5 tons, Kazakhstan 4.3 tons, Ukraine 1.2 tons, Tajikistan 0.4 ton, and Belarus 0.1 tonnes, according to the IMF.

Ukraine, Czech Republic and Belarus also had modest increases in their gold reserves.

Central banks are expanding reserves due to concerns about the dollar, euro, sterling and all fiat currencies.

There is an increasing realisation amongst central bankers that gold is a less risky alternative to most paper currencies and a recent survey showed that that majority of central bank reserves managers were favourable towards gold.

Signifying the mood of caution among the world’s central bankers, 71% of those polled said gold was a more attractive investment than it had been at the start of last year.

Central banks added 439.7 tons last year, the most in almost five decades, and may buy a similar amount if not more in 2012, the World Gold Council and many analysts believe.

Turkey’s central bank increased the proportion of required reserves that commercial banks can deposit in gold last year. The changes have increased the amount of bullion the country, which owns 209.6 tons, declares in its official reserves.

President Vladimir Putin

President Vladimir Putin

Gold accounts for about 3.9 percent of Mexico’s total reserves and 9.7 percent of Russia’s, according to the World Gold Council. That compares with more than 70 percent for the U.S. and Germany, the biggest bullion holders, the data show.

The IMF data records the People’s Bank of China data showing that at the end of March China’s gold reserves remained unchanged at 33.88 million ounces.

This seems hard to believe and it remains likely that China is again quietly accumulating gold reserves and the PBOC will announce a material increase in their reserves when they are ready to do so.

IMF data released overnight shows that Mexico added 16.8 metric tons of gold valued at about $906.4 million to its reserves in March.

Russia continued to diversify its foreign exchange reserves and increased its gold reserves by about 16.5 tons according to a statement by its central bank on April 20.

Changes to Gold Holdings in IMF (March) - Reuters Global Gold Forum

Other creditor nations with large foreign exchange reserves and exposure to the dollar and the euro including Turkey and Kazakhstan also increased their holdings of gold according to the International Monetary Fund data.

Mexico raised its reserves to 122.6 tons last month when gold averaged $1,676.67 an ounce.

Turkey added 11.5 tons, Kazakhstan 4.3 tons, Ukraine 1.2 tons, Tajikistan 0.4 ton, and Belarus 0.1 tonnes, according to the IMF.

Ukraine, Czech Republic and Belarus also had modest increases in their gold reserves.

Central banks are expanding reserves due to concerns about the dollar, euro, sterling and all fiat currencies.

There is an increasing realisation amongst central bankers that gold is a less risky alternative to most paper currencies and a recent survey showed that that majority of central bank reserves managers were favourable towards gold.

Signifying the mood of caution among the world’s central bankers, 71% of those polled said gold was a more attractive investment than it had been at the start of last year.

Central banks added 439.7 tons last year, the most in almost five decades, and may buy a similar amount if not more in 2012, the World Gold Council and many analysts believe.

Turkey’s central bank increased the proportion of required reserves that commercial banks can deposit in gold last year. The changes have increased the amount of bullion the country, which owns 209.6 tons, declares in its official reserves.

President Vladimir Putin

President Vladimir Putin Gold accounts for about 3.9 percent of Mexico’s total reserves and 9.7 percent of Russia’s, according to the World Gold Council. That compares with more than 70 percent for the U.S. and Germany, the biggest bullion holders, the data show.

The IMF data records the People’s Bank of China data showing that at the end of March China’s gold reserves remained unchanged at 33.88 million ounces.

This seems hard to believe and it remains likely that China is again quietly accumulating gold reserves and the PBOC will announce a material increase in their reserves when they are ready to do so.

_____________________

So Ben, you Bubbleheaded Boobie, do you still think Gold is not money?

Got Gold You Can Hold?

Got Silver You Can Squeeze?

It Is Not Too Late Too Accumulate!!!

No comments:

Post a Comment