Did I hear Ben Bernanke say, "Buy gold and short bonds" during his testimony in the Senate today?

UBS: "Many observers assume that, once bad debt is purchased by the central bank, the debt crisis is solved for good." they are wrong.

Bernanke plays down easing concerns

By Robin Harding in Washington

February 26, 2013 3:02 pm

February 26, 2013 3:02 pm

Ben Bernanke played down concerns about quantitative easing limits in dovish testimony to Congress that suggests the US Federal Reserve will continue to purchase assets.

The Fed chairman systematically went through the costs and risks of its third round of quantitative easing, known as QE3, and argued that they were either offset by other benefits or else the central bank had them under control.

Mr Bernanke’s testimony to the Senate banking committee resets the Fed’s public stance after minutes of its recent meetings showed that “many” on the rate-setting Federal Open Market Committee are concerned about the costs and risks of QE3.

His remarks suggest that those concerns are not so great that the Fed might cut short QE3 – under which it is buying assets at a pace of $85bn a month – before meeting its goal of a substantial improvement in the labour market.

Mr Bernanke said that the benefits of asset purchases are clear. “Monetary policy is providing important support to the recovery while keeping inflation close to the FOMC’s 2 per cent objective.”

________________________________

The Fed Chairman is a total pro. He spoke for two hours and said almost nothing.

In 1966, Alan Greenspan accurately observed: “In the absence of gold, there is no way to protect savings from confiscation through inflation. This is the shabby secret of the welfare state’s tirade against gold. If everyone decided to convert his bank deposits into gold and silver… private assets would be preserved but Government created credit would be become worthless.”

Everyone should take the time to read Mr. Greenspan’s original writing. Here it is:

http://www.321gold.com/fed/greenspan/1966.html

This is very insightful and informative.

Everyone should take the time to read Mr. Greenspan’s original writing. Here it is:

http://www.321gold.com/fed/greenspan/1966.html

This is very insightful and informative.

____________________________

Fed is 'nowhere close' to raising rates and tightening, Rickards tells Kitco News

Submitted by cpowell on Tue, 2013-02-26 00:43. Section: Daily Dispatches

Gold & Silver Smash Orchestrated By The BIS

Stunning $24 Premiums For Gold In Shanghai

4:35p PT Monday, February 25, 2013

Dear Friend of GATA and Gold:

Market analyst and hedge fund manager James G. Rickards, author of the best-selling book "Currency Wars," today tells Kitco News' Daniela Cambone that the Federal Reserve is "nowhere close" to raising interest rates and tightening monetary conditions. Rickards adds that gold's volatility lately has been the dollar's and that gold simply should be purchased and socked away because it will do fine over time. The interview is 21 minutes long and can be viewed at Kitco News here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

____________________________

Maguire - Stunning 225 Tons of Physical Gold Bought By CBs

Today whistleblower Andrew Maguire told King World News that Eastern central banks have taken a massive 225 tons out of the physical gold market on this recent takedown. This is the first in a series of interviews with Maguire lifting the curtain on what is going on behind the scenes in the ongoing gold and silver war which continues to rage.

Eric King: “Give me an idea of the amount of tonnage being purchased on this decline.”

Maguire: “If you look at the daily tonnage being drawn down, we’re (now) looking at 20 to 30 tons per day of real allocations in dollar and euro gold. Shanghai delivery volumes have been extremely large as well on a daily basis. That’s just what we see clearing here through London and Shanghai....

Today whistleblower Andrew Maguire told King World News that that the Bank for International Settlements (BIS) orchestrated this latest takedown in gold and silver. Maguire also stated there is now a major dislocation in the gold and silver markets that is about to blow up. This is the second in a series of interviews with Maguire lifting the curtain on what is going on behind the scenes in the ongoing gold and silver war which continues to rage. Below is Part II of Maguire’s extraordinary interview.

Whistleblower Andrew Maguire: “The gold and silver markets have become virtual markets. There is no physical aspect, essentially, to the way they trade on an intraday basis. Extremely large volumes of synthetic supply are just created and exchanged. That’s primarily through the bullion banks, which also have exposure to the physical market, and the managed money and the specs.

So when you look at the COMEX, it’s not a delivery market. It’s actually no more than a casino. The price of real physical gold in the actual world markets is, by default, set at the margin because of this incredible leverage. It bears absolutely no relationship to the real, unleveraged supply/demand fundamentals.

But here is what we are actually witnessing now: This dislocation is about to blow up....

Today whistleblower Andrew Maguire spoke with King World News about the stunning premiums being paid in Shanghai for gold, and what price investors and traders need to watch to see buy stops triggered on the upside in the gold market. This is the third and final in a series of interviews with Maguire lifting the curtain on what is going on behind the scenes in the ongoing gold and silver war which continues to rage. Below is Part III of Maguire’s extraordinary interview.

Whistleblower Andrew Maguire: “We were already hearing rumors two weeks ago of another CME broker default (when gold was pushing $1,700), and I think something had to be done. Up until the Monday when China went on holiday, these dips were being aggressively bought, forcing the bullion banks on the bid to meet every allocation.

This is why gold couldn’t break down below the mid-$1,650s. So what did they (bullion banks) do? They waited until the paper markets had no competition. Waited until China was on holiday and most of Asia was closed, and then they targeted absolutely visible long stops.

This (subsequent action) is drawing in auto-traded, managed money short interest, and essentially this is what they have started to cover into....

The entire KWN audio interview with Andrew Maguire is available HERE

______________________

February's Strange Divergence In Precious Metals

Submitted by Tyler Durden on 02/26/2013 13:38 -0500

February has been an odd month for precious metals to say the least. On-again, off-again fears of Bernanke removing the punchbowl (and endless sell-side strategists discussing Great Rotations and the end of the gold cycle) have led to prices for gold and silver sliding notably. However, while all this price deterioration has been going on, demand for physical gold and silver has surged - entirely disconnecting from January's apparent demand-to-price correlation - and Silver set to break all-time record demand highs for a February. We know who was buying in January, as Reuters reports Russia and Turkey were significantly adding to their bullion reserves; and while the divergence between demand and price coincided with Chinese New Year - leaving a large marginal buying nation on the sidelines - we suspect the drop is more to do with hedge fund reflexive selling - now caught offside. It seems at least one smart player was using lower prices to build their stack; manipulation or no manipulation.

The climaxing day of any capitulation marks peak bearishness, when everyone is utterly convinced the falling price will keep selling off indefinitely.And indeed on Wednesday, we saw a rash of hyper-bearish predictions for gold.Many analysts claimed its secular bull was ending.I had to chuckle at that, as its latest interim high was 18 months earlier in August 2011.Highs are when to be bearish, not new lows!

This week’s capitulation was the end result of a multi-month decay process that began with alternative investments falling out of favor in November.Remember that gold and the SPX had a 0.55 positive correlation between January and October 2012.From November to this week, that reversed totally to a much stronger 0.74negative correlation!The levitating stock markets’ melt-up rally really weighed on gold sentiment.

That alone is a very bullish omen.The general stock markets are topping, due to roll over into a new cyclical bear.The SPX’s cyclical bull that began in March 2009 is long in the tooth.As of this week it had powered 126.3% higher over 47 months, far bigger and longer than the mid-secular-bear cyclical-bull average of a doubling over 35months.And complacency is off the charts, the primary topping indicator.

So the probabilities overwhelmingly favor a major selloff in the stock markets, likely a new cyclical bear that will cut the SPX in half over a couple years.Just as alternative investments fall out of favor when stock bulls top, they regain favor in a big way as stock bears deepen.This dynamic is certainly very bullish for gold today, which has been a proven performer in this secular stock bear’s past cyclical bears.

But even without the prospects for a new stock bear, gold’s technicals still look very bullish despite this week’s capitulation.In the chart above note that gold has beenconsolidating high, trading in a range between roughly $1550 and $1775.Despite all the technical carnage this week, gold still remains above its longstanding consolidation support!From these same levels last summer, a major rally was born.

I’ve been studying and trading the markets for decades, and I would love to be able to predict capitulations.Seeing them coming would make trading a loteasier.Normally you want to buy low late in a correction, and the majority of corrections don’t end in capitulations.But for the exceptions that do, the absolute best time to buy is that very capitulation day.As fear peaks, prices are at their cheapest.

But unfortunately capitulations are inherently unpredictable.Much of the time a long demoralizing selloff necessary to fuel a capitulation doesn’t experience a proper spark before the next upleg begins.So if you waited for a capitulation that never came before buying, you’d miss the low prices.Each capitulation requires a complex intertwined mix of events, technicals, and sentiment that are unique to that time.

So the only rational strategy for bulls is to buy cheap late in corrections without waiting for capitulations that usually don’t come.But when they do, simply steel yourself and weather the brief plunge.They are a great test of your contrarian mettle, separating those who can really walk the walk from those who merely talk the talk.If gold looks like a bargain before a capitulation, it is far more attractive after one.

____________________________

February has been an odd month for precious metals to say the least. On-again, off-again fears of Bernanke removing the punchbowl (and endless sell-side strategists discussing Great Rotations and the end of the gold cycle) have led to prices for gold and silver sliding notably. However, while all this price deterioration has been going on, demand for physical gold and silver has surged - entirely disconnecting from January's apparent demand-to-price correlation - and Silver set to break all-time record demand highs for a February. We know who was buying in January, as Reuters reports Russia and Turkey were significantly adding to their bullion reserves; and while the divergence between demand and price coincided with Chinese New Year - leaving a large marginal buying nation on the sidelines - we suspect the drop is more to do with hedge fund reflexive selling - now caught offside. It seems at least one smart player was using lower prices to build their stack; manipulation or no manipulation.

Cumulative demand for Gold vs Spot price... (corrected)

Cumulative demand for Silver vs Spot price (corrected)

and this month looks set to see the biggest demand for silver (for a Feb) ever...

Source: Bloomberg and US Mint

___________________________

Holy Hedge Fund Shorting: 'Game On' For Gold And Silver

The emergence of technical fund and speculative short selling has created the finishing touches to a market structure set up that is good to go in gold and maybe in silver as well... The bottom line is that an important price low is being put in, if it has not been seen already. - Ted Butler

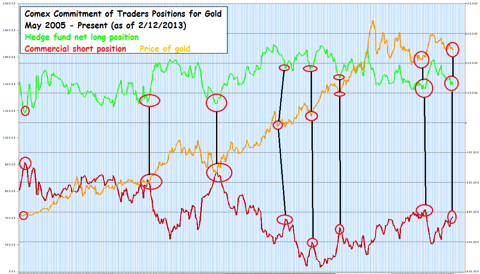

I wanted to follow up on my article last week that analyzed the Comex Commitment of Traders (COT) for gold futures. I had suggested the likelihood that the recent increase in the gold futures short position of the large hedge funds, and the concomitant large reduction in the net short position of the commercial traders (mainly the bullion banks), was a signal that this vicious price correction in gold/silver is nearly over.

The COT report released Friday (through Tuesday's cut-off day) was nothing short of stunning. I knew the hedge funds were piling onto the short side of gold and silver, and that's why the metals have been getting slaughtered recklessly like this. But the increase in the hedge fund gold short position is unprecedented, as far as I know. In other words, I can only recall one or two times when even the big banks increased their gold short by this much.

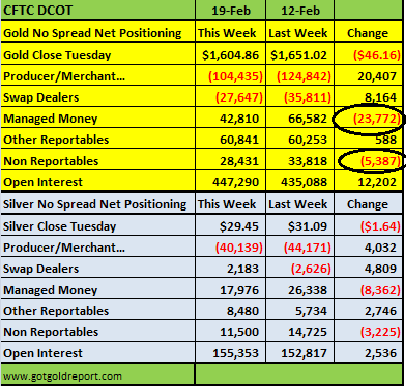

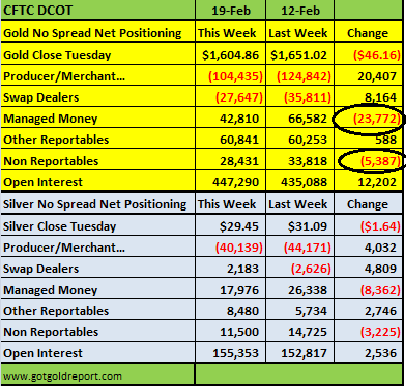

Let's look at the numbers -- here's the COT report in table format from the Got Gold Report:

(click to enlarge)

The red numbers that I've circled above represent the increase in Comex gold short interest for the large hedge fund and retail trader (small specs) categories. With gold, the hedge funds increased their gold short by 23.7K, while the banks (Producer/Merchant and Swap Dealers) covered 28.5K. The small specs increased their short position by an incredible 18.6%, or 5.3K.

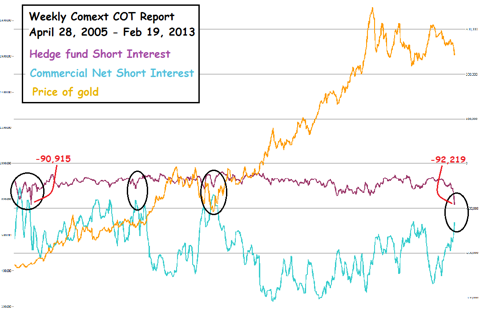

Here's a graph going back to the last Friday in April 2005, which shows the weekly hedge fund gross short interest, the big bank net short interest and the price of gold:

As you can see, the hedge fund short position is at a record level. I show the big bank net short position because it captures both the magnitude of short-covering and the increased gross long position of the banks. The black circles show the points in time when the hedge fund gross short position and the bank net short position converge in magnitude. You can see what happens to the price of gold when this dynamic occurs.

____________________________

Gold Capitulation

Published : February 23rd, 2013

This week’s capitulation was the end result of a multi-month decay process that began with alternative investments falling out of favor in November.Remember that gold and the SPX had a 0.55 positive correlation between January and October 2012.From November to this week, that reversed totally to a much stronger 0.74negative correlation!The levitating stock markets’ melt-up rally really weighed on gold sentiment.

That alone is a very bullish omen.The general stock markets are topping, due to roll over into a new cyclical bear.The SPX’s cyclical bull that began in March 2009 is long in the tooth.As of this week it had powered 126.3% higher over 47 months, far bigger and longer than the mid-secular-bear cyclical-bull average of a doubling over 35months.And complacency is off the charts, the primary topping indicator.

So the probabilities overwhelmingly favor a major selloff in the stock markets, likely a new cyclical bear that will cut the SPX in half over a couple years.Just as alternative investments fall out of favor when stock bulls top, they regain favor in a big way as stock bears deepen.This dynamic is certainly very bullish for gold today, which has been a proven performer in this secular stock bear’s past cyclical bears.

But even without the prospects for a new stock bear, gold’s technicals still look very bullish despite this week’s capitulation.In the chart above note that gold has beenconsolidating high, trading in a range between roughly $1550 and $1775.Despite all the technical carnage this week, gold still remains above its longstanding consolidation support!From these same levels last summer, a major rally was born.

I’ve been studying and trading the markets for decades, and I would love to be able to predict capitulations.Seeing them coming would make trading a loteasier.Normally you want to buy low late in a correction, and the majority of corrections don’t end in capitulations.But for the exceptions that do, the absolute best time to buy is that very capitulation day.As fear peaks, prices are at their cheapest.

But unfortunately capitulations are inherently unpredictable.Much of the time a long demoralizing selloff necessary to fuel a capitulation doesn’t experience a proper spark before the next upleg begins.So if you waited for a capitulation that never came before buying, you’d miss the low prices.Each capitulation requires a complex intertwined mix of events, technicals, and sentiment that are unique to that time.

So the only rational strategy for bulls is to buy cheap late in corrections without waiting for capitulations that usually don’t come.But when they do, simply steel yourself and weather the brief plunge.They are a great test of your contrarian mettle, separating those who can really walk the walk from those who merely talk the talk.If gold looks like a bargain before a capitulation, it is far more attractive after one.

____________________________

U.S. Already in Technical Default-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com

Analyst Gregory Mannarino is worried about the out of control debt in America. Mannarino says, “The United States is already in technical default regarding its debt because if it were not for the Fed buying all this debt, we’d be in actual default, which is coming.” When the bond market bubble blows up, Mannarino thinks, “People are going to be destroyed here—destroyed from a financial standpoint.” It is an official “open ended” policy for the Fed to buy $85 billion in debt each and every month. Mannarino says, “This is a very dangerous game the Fed is playing. It is very scary. They are creating a greater and greater imbalance between the supply and demand for the U.S. dollar. . . . Inflation is starting to kick in, and it’s just the beginning.” Join Greg Hunter as he goes One-on-One with Gregory Mannarino from TradersChoice.net.

____________________________

Gold Has One Way to Go-Up-Peter Schiff

By Greg Hunter’s USAWatchdog.com

Money manager Peter Schiff predicts, “We are headed for a monetary crisis, a dollar crisis. . . . Money supplies are going to explode, and gold supplies are going to be constricted.” According to Schiff, that means only one thing,“The price of gold has one way to go in the long term, and that is up.” Schiff says the reason why it hasn’t ignited is because, “People are buying into this myth the economy is recovering. . . . We’re facing a worse crisis than ever.” Schiff thinks the real reason why the federal government is suing the S&P rating agency is because it downgraded U.S. Treasuries last year. Schiff says, “The reason why they’re being sued is not only because of what they did but to send a message to the other ratings agencies that you better not downgrade U.S. Treasuries.” Schiff predicts, “People who own Treasuries are going to lose a lot of money.” Join Greg Hunter as he goes One-on-One with Peter Schiff of Euro Pacific Precious Metals.

____________________________

The Sequestration Debate Misses the REAL Issue

Sequestration means across-the-board cuts in government spending, split 50%-50% between the military and domestic spending.

As this post will show, the hypocrisy surrounding the sequestration debate is stunning.

For example, president Obama says that sequestration is the GOP’s fault. But Bob Woodward and YouTube reveal that Obama supported sequestration from day one.

And Dems obviously want to slash military spending and protect domestic programs, while the GOP wants to slash entitlements and leave military spending as is.

But the whole sequestration debate misses the bigger picture: Tremendous savings can be wrung out of both military and domestic spending without reducing services to either.

____________________________

The hypocrisy surrounding the sequestration debate is stunning.

____________________