The State of the Dollar

Editorial of The New York Sun | February 11, 2013

Yet we haven’t seen in the headlines about the pending presidential palaver even one mention of the topic that, by our lights, rises above all the others. This is the state of the dollar. Particularly in an age of fiat money, where there is no gold or silver backing for our national currency and the only basis of it is the economic good fortune of the nation, well, particularly in such an age, the state of the dollar can be seen as a proxy for the state of the union itself.

If so, the state of the union is at a historic low. We have rehearsed this point so often in these columns that we fear our loyal readers are in danger of becoming afflicted with monetary monotony. We run the risk because of the aphorism of the Robert L. Bartley, now sadly deceased. “It takes 75 editorials to pass a law,” he said. He was speaking of a newspaper that had a daily circulation of 2 million copies. Imagine how many editorials it will take from us more modest sized newspapers.

This topic happens to be getting hotter by the week. The biggest development of late, in our book, was the decision of the Wall Street Journal to issue the op-ed piece by John Taylor warning that the supposedly stimulative monetary policy that Chairman Bernanke and his colleagues have been running is actually a drag on the recovery. That would be like a fire department discovering that the water with which it is hosing down a blaze is flammable.

So what in the world does the President think of monetary policy? Why has he been so all-fired mum on the subject? The question nags at us, particularly in light of his comments during the 2008 campaign. He made them in a meeting with the editors of the Sentinel, a newspaper that is issued at Keene, New Hampshire. We wrote about Mr. Obama’s comments in 2011, when the value of the dollar collapsed to below a 1,500th of an ounce of gold.

The question that had been put to Mr. Obama in 2008 — it was perfectly asked by the Sentinel's editor, Jim Rousmaniere — was about the decline of the dollar. “Is that good or bad?” the candidate was asked. Mr. Obama tried briefly to suggest that there were some benefits to a weak dollar, but he was too smart to stick with that argument — at least while he was running for office. The last guy who tried it was a certain peanut farmer who was trying for a second term.

Then Mr. Obama noted that we hadn’t seen inflation — yet. “It’s not going to last forever,” he said. “So the downside is we’re going to see inflationary pressures as a consequence of this.” Then the candidate asserted that he was “less concerned” about the day to day gyrations of the dollar than “by the underlying economic fundamentals that are causing the dollar to decline,” which he characterized as “that we’re spending more than we produce, and you know we are losing our competitive edge.”

So how’s that working out now that Mr. Obama is beginning his second term? The Federal Reserve has expanded its balance sheet to levels it would once have been hard even to dream about. Our central bank is exposed, as George Melloan wrote in a column in these pages called “The Fed’s Worst Fear,” to the bond market. More than a dozen states are eying making gold and silver coins legal tender. A vast bi-partisan majority of the House wants to audit the Fed, and a new avant garde is talking about the gold standard. Isn’t it past time for the President to say something to the Congress and to the American people about the state of the dollar?

http://www.nysun.com/editorials/the-state-of-the-dollar/88190/

____________________________

Obama's Treasury Pick Says He Supports Strong U.S. Dollar

From Reuters

Wednesday, February 13, 2013

Wednesday, February 13, 2013

WASHINGTON -- Jack Lew, President Barack Obama's pick to run the Treasury Department, on Wednesday said he would support a strong U.S. dollar, in line with longstanding U.S. policy.

"Treasury has had a longstanding provision through administrations of both parties that a strong dollar is in the best interests of promoting U.S. growth, productivity and competitiveness," Lew said during a hearing vetting him for Treasury secretary, in response to a question.

"If confirmed, I would not change that policy."

____________________________

But just how is the 'strong dollar' policy implemented, except by suppressing gold? Nobody in political authority or journalism ever asks. Is it implemented at the end of the barrel of a gun, or perhaps with a smart bomb or maybe a drone strike?____________________________

For an example of "dumb Dollar policy" please refer to comments by then Fed Governor Ben S. Bernanke:

Remarks by Governor Ben S. Bernanke

Before the National Economists Club, Washington, D.C. November 21, 2002

Before the National Economists Club, Washington, D.C. November 21, 2002

Deflation: Making Sure "It" Doesn’t Happen Here

Since World War II, inflation–the apparently inexorable rise in the prices of goods and services–has been the bane of central bankers. Economists of various stripes have argued that inflation is the inevitable result of (pick your favorite) the abandonment of metallic monetary standards, a lack of fiscal discipline, shocks to the price of oil and other commodities, struggles over the distribution of income, excessive money creation, self-confirming inflation expectations, an "inflation bias" in the policies of central banks, and still others. Despite widespread "inflation pessimism," however, during the 1980s and 1990s most industrial-country central banks were able to cage, if not entirely tame, the inflation dragon. Although a number of factors converged to make this happy outcome possible, an essential element was the heightened understanding by central bankers and, equally as important, by political leaders and the public at large of the very high costs of allowing the economy to stray too far from price stability.

With inflation rates now quite low in the United States, however, some have expressed concern that we may soon face a new problem–the danger of deflation, or falling prices. That this concern is not purely hypothetical is brought home to us whenever we read newspaper reports about Japan, where what seems to be a relatively moderate deflation–a decline in consumer prices of about 1 percent per year–has been associated with years of painfully slow growth, rising joblessness, and apparently intractable financial problems in the banking and corporate sectors. While it is difficult to sort out cause from effect, the consensus view is that deflation has been an important negative factor in the Japanese slump.

So, is deflation a threat to the economic health of the United States? Not to leave you in suspense, I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small, for two principal reasons. The first is the resilience and structural stability of the U.S. economy itself. Over the years, the U.S. economy has shown a remarkable ability to absorb shocks of all kinds, to recover, and to continue to grow. Flexible and efficient markets for labor and capital, an entrepreneurial tradition, and a general willingness to tolerate and even embrace technological and economic change all contribute to this resiliency. A particularly important protective factor in the current environment is the strength of our financial system: Despite the adverse shocks of the past year, our banking system remains healthy and well-regulated, and firm and household balance sheets are for the most part in good shape. Also helpful is that inflation has recently been not only low but quite stable, with one result being that inflation expectations seem well anchored. For example, according to the University of Michigan survey that underlies the index of consumer sentiment, the median expected rate of inflation during the next five to ten years among those interviewed was 2.9 percent in October 2002, as compared with 2.7 percent a year earlier and 3.0 percent two years earlier–a stable record indeed.

The second bulwark against deflation in the United States, and the one that will be the focus of my remarks today, is the Federal Reserve System itself. The Congress has given the Fed the responsibility of preserving price stability (among other objectives), which most definitely implies avoiding deflation as well as inflation. I am confident that the Fed would take whatever means necessary to prevent significant deflation in the United States and, moreover, that the U.S. central bank, in cooperation with other parts of the government as needed, has sufficient policy instruments to ensure that any deflation that might occur would be both mild and brief.

Of course, we must take care lest confidence become over-confidence. Deflationary episodes are rare, and generalization about them is difficult. Indeed, a recent Federal Reserve study of the Japanese experience concluded that the deflation there was almost entirely unexpected, by both foreign and Japanese observers alike (Ahearne et al., 2002). So, having said that deflation in the United States is highly unlikely, I would be imprudent to rule out the possibility altogether. Accordingly, I want to turn to a further exploration of the causes of deflation, its economic effects, and the policy instruments that can be deployed against it. Before going further I should say that my comments today reflect my own views only and are not necessarily those of my colleagues on the Board of Governors or the Federal Open Market Committee.

Deflation: Its Causes and Effects

Deflation is defined as a general decline in prices, with emphasis on the word "general." At any given time, especially in a low-inflation economy like that of our recent experience, prices of some goods and services will be falling. Price declines in a specific sector may occur because productivity is rising and costs are falling more quickly in that sector than elsewhere or because the demand for the output of that sector is weak relative to the demand for other goods and services. Sector-specific price declines, uncomfortable as they may be for producers in that sector, are generally not a problem for the economy as a whole and do not constitute deflation. Deflation per se occurs only when price declines are so widespread that broad-based indexes of prices, such as the consumer price index, register ongoing declines.

Deflation is defined as a general decline in prices, with emphasis on the word "general." At any given time, especially in a low-inflation economy like that of our recent experience, prices of some goods and services will be falling. Price declines in a specific sector may occur because productivity is rising and costs are falling more quickly in that sector than elsewhere or because the demand for the output of that sector is weak relative to the demand for other goods and services. Sector-specific price declines, uncomfortable as they may be for producers in that sector, are generally not a problem for the economy as a whole and do not constitute deflation. Deflation per se occurs only when price declines are so widespread that broad-based indexes of prices, such as the consumer price index, register ongoing declines.

The sources of deflation are not a mystery. Deflation is in almost all cases a side effect of a collapse of aggregate demand–a drop in spending so severe that producers must cut prices on an ongoing basis in order to find buyers.1 Likewise, the economic effects of a deflationary episode, for the most part, are similar to those of any other sharp decline in aggregate spending–namely, recession, rising unemployment, and financial stress.

However, a deflationary recession may differ in one respect from "normal" recessions in which the inflation rate is at least modestly positive: Deflation of sufficient magnitude may result in the nominal interest rate declining to zero or very close to zero.2 Once the nominal interest rate is at zero, no further downward adjustment in the rate can occur, since lenders generally will not accept a negative nominal interest rate when it is possible instead to hold cash. At this point, the nominal interest rate is said to have hit the "zero bound."

_______________________________

Why Fed Policy Is Hurting The Economy

John Taylor wrote a very interesting article in the Wall Street Journal last week, "Fed Policy Is a Drag on the Economy," in which he argues that the Fed has been hurting the economy by keeping short-term interest rates extremely low, and promising to keep them extremely low for a long time. This of course runs directly counter to what we have been led to believe.

He describes a variety of problems created by super-easy monetary policy (e.g., encouraging people to take on too much risk, creating great uncertainty about the Fed's ability to reverse its QE efforts, making it easy for the federal government to fund its massive spending plans, and forcing other central banks to follow suit). More importantly, perhaps, he argues that very low interest rates create disincentives to save, and this limits the economy's ability to grow. "While borrowers might like a near-zero rate, there is little incentive for lenders to extend credit at that rate. ... lenders supply less credit at the lower rate. The decline in credit availability reduces aggregate demand, which tends to increase unemployment, a classic unintended consequence of the policy."

In other words, while everyone, including the Fed, thinks that ultra low interest rates provide an important source of stimulus to the economy, it's quite likely that they do just the opposite. The Law of Unintended Consequences strikes yet again.

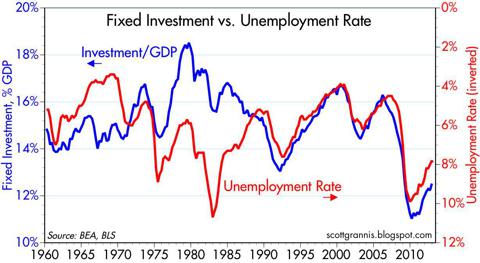

Taylor had a somewhat-related blog post the other day in which he discusses the "strong inverse relationship between fixed investment and the unemployment rate." He accompanied the post with a chart that got my attention, because I saw a way to improve it.

The above chart uses the same data as Taylor's original chart, but includes data going back to 1960 (his only went back to 1990). The interpretation of the chart remains the same. There is a strong inverse relationship between fixed investment as a share of GDP (fixed investment includes private residential and nonresidential construction, and private investment in equipment and software) and the unemployment rate, which is a good proxy for the health of the economy. He is careful to note that while the correlation is strong, we cannot infer the direction of causality. But this does illustrate how a lack of investment could go a long way to explaining why the recovery has been so weak.

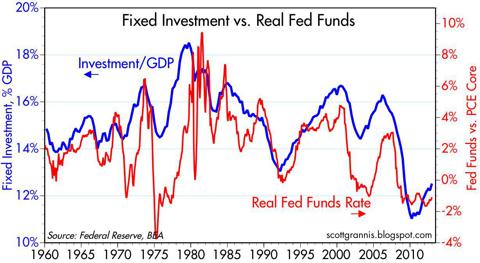

It then occurred to me to put his two ideas together, to see if the Fed's monetary policy was correlated with the amount of fixed investment. Where Taylor's WSJ article focuses on how artificially low interest rates limit lending and therefore aggregate demand, and his chart compares fixed investment to the unemployment rate, I wanted to see if there was a link between Fed policy and fixed investment.

As the chart above shows, Fed policy is indeed highly correlated to fixed investment (even more so than the unemployment rate is). This fits hand in glove with the first chart, which links fixed investment to the unemployment rate. The red line in the above chart is the real Federal funds rate (using the Core PCE deflator), since that is a good proxy for the degree to which monetary policy is "tight" or "easy."

This puts some meat on the bones of Taylor's WSJ article. The Fed's unusually accommodative monetary policy stance -- which promises extremely low interest rates (negative in real terms) for a long time to come -- does appear to be a factor in limiting the amount of funds available for investment, and in reducing aggregate demand. And that in turn helps to explain why the recovery has been so weak.

How else to explain the fact that fixed investment is almost always very strong when monetary policy is very tight, and weak when monetary policy is easy? How else to explain how a decade of extremely low interest rates have failed to stimulate Japan's economy?

Food for thought and controversy.

____________________________

Occam's Gold vs Rube Goldberg's Fiat

Submitted by Tyler Durden on 02/11/2013 21:35 -0500

From the 'simplicity' of a Gold Standard to the 'complexity' of our current fiat system, Santiago Capital draws a handy analogy between the over-complicated machines of 'Rube Goldberg' that represents the interactions between the various actors affecting the size and velocity of our monetary base and the 'simplest possible, but no simpler' world of 'Occam's Razor'-prone gold. In two brief presentations, Brent Johnson introduces the two systems and explains that in order to keep the shark of our economy alive, one of two things must happen: monetary velocity must be maintained or the monetary base must rise. Obviously both are inflationary. From how the system is designed to its drastic implications, simple, brief, concise, and what to do about it.

____________________________

Global central banks have "printed" over $11 TRILLION collectively since the financial crisis began in 2008. We have been lead to believe that this was necessary to "get the global economy growing again". I guess not:

Futures Slump As Global Q4 GDPs Dump

Submitted by Tyler Durden on 02/14/2013 07:11 -0500

It started overnight in Japan, where Q4 GDP posted a surprising and disappointing 3rd quarter of declines, then quickly spread to France, whose Q4 GDP declined -0.3% Q/Q missing expectations of a -0.2% drop, down from a +0.1% increase, then Germany, whose GDP also missed expectations of a -0.5% drop, declining from a +0.2% increase to a -0.6% drop, then on to Italy (-0.9% vs Exp. -0.6%, last -0.2%), Portugal (-1.8%, Exp. -1.0%, last -0.9%), Greece (down -6.0%, previously -6.7%), Hungary (-0.9%, Exp. -0.3%), Austria (-0.2%, down from 0.1%), Cyprus (-3.1%, last -2.0%), and so on.

____________________________

WHO IN THEIR RIGHT MIND WOULD BE SELLING THEIR PHYSICAL GOLD AND SILVER AT A DARK TIME LIKE THIS?

No comments:

Post a Comment